Amazon enforces title rules, Wise expands access in Ukraine, e-commerce rebounds, TikTok drives Amazon sales, and listing variations face cleanup

This week’s updates highlight shifting dynamics across Amazon and beyond. The marketplace is cracking down on title formats for compatible products, while Wise expands card access for sellers in Ukraine. U.S. e-commerce has returned to pandemic-era highs, and TikTok is emerging as a powerful Amazon sales driver. Plus, sellers must prepare for Amazon’s removal of outdated variation themes starting in September.

News #1. Amazon Reinforces Title and Content Rules for Compatible Products

Amazon has issued a reminder to sellers about its strict requirements for creating listings of products compatible with other brands.

The marketplace now expects sellers to follow a specific title structure:

Branded products:[Your Brand] + [Product] + "for/compatible with/fits" + [Brand/Product]

Example: TonTon Sleeve intended for Kindle FireGeneric products:Generic + [Product] + "for/compatible with/fits" + [Brand/Product]

Example: Generic Replacement Filter for AmazonBasics Waterfilter A3In product descriptions, sellers may reference brand names (e.g., Kindle), but only to indicate compatibility, not as part of marketing claims.

Why This Matters

Incorrectly formatted titles can lead to trademark violations and result in blocked listings. Such policy breaches directly affect Account Health, and repeated violations can escalate to full account deactivation.

What Sellers Should Do

By tightening these requirements, Amazon is aiming to better protect brands and customers. For private label sellers offering accessories or compatible items for major branded products, it’s crucial to review all titles and ensure they fully meet Amazon’s guidelines.

Audit existing listings to confirm compliance with the required format.

Update titles via Manage All Inventory. Amazon notes that corrected listings should be reinstated within 8 hours, and related violations will be removed from Account Health.

Monitor Seller Central notifications and resolve compliance issues quickly to avoid disruptions.

News #2. Wise Expands Card Access, Opens Registration for Users in Ukraine

While not directly tied to Amazon US, this update is highly relevant for many Amazon sellers. Most marketplace entrepreneurs register their companies in the United States, and payment services like Wise play a critical role in managing cross-border finances.

Recently, some Wise users — specifically business owners with U.S.-registered companies — reported receiving notifications that Wise US business accounts and corporate cards with USD bank details are now available to residents of Ukraine.

At this stage, Wise has not released an official announcement or updated its published policies to confirm the change. For now, the information comes only from user reports.

We’ll continue monitoring the situation and share details as soon as Wise provides further clarification.

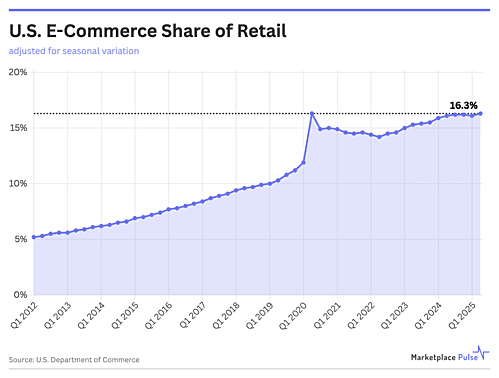

News #3. E-Commerce Returns to Pandemic-Era Peak Levels

According to the U.S. Census Bureau, e-commerce accounted for 16.3% of total U.S. retail sales in Q2 2025 — matching the surge level first reached during the Covid-19 lockdowns. At that time, online sales appeared to grow endlessly, but after restrictions eased, the share dropped and then plateaued for several years.

Why This Matters

The current rebound reflects a healthier, more gradual growth pattern. Online sales are rising not due to artificial spikes, but because of lasting shifts in consumer habits: shoppers continue choosing online over offline more frequently.

It’s also important to note that this growth comes amid overall expansion in retail. Total retail sales climbed from $5.25 trillion in 2018 to $7.38 trillion in 2024 — a 40% increase in just six years. Both online and offline sales are expanding, with e-commerce steadily gaining share.

What This Means for Amazon Sellers

After the post-pandemic plateau, the market has finally returned to a sustainable growth trajectory. For Amazon sellers, this means more stable and predictable conditions — but staying ahead of competitors remains critical.

Online shopping is back on an upward trend — and Amazon remains the biggest beneficiary.

Competition is intensifying as the marketplace continues to take share from traditional retail.

Sellers will see growing demand, but profits will favor those who optimize listings, manage reviews, and invest in ads effectively.

News #4. Amazon + TikTok: What This Partnership Means for Sellers

Amazon recently rolled out its integration with TikTok, allowing users to discover Amazon products directly in their TikTok feed and purchase without leaving the app. The partnership is already live, yet many sellers underestimate how significant it may become.

Expert Perspective

Amazon expert Vanessa Hung points out that TikTok remains the strongest player in social commerce. According to her, this partnership gives TikTok an edge over competitors like Instagram and YouTube, while Amazon gains access to a unique channel for buyer engagement.

Unlike traditional search-driven shopping, TikTok’s algorithm pushes products to users through recommendations and viral content. This flips the traditional sales model, shifting from search-based discovery to content-driven purchasing.

Why It Matters for Sellers

TikTok is evolving into a true traffic channel for Amazon listings, not just a platform for creative testing.

Brands that adapt their marketing to short-form video and TikTok trends gain a clear advantage: shoppers can jump directly from content to purchase.

Ignoring this trend is risky. TikTok’s younger audience is more prone to impulse buying, shaping the next wave of consumer demand.

What Sellers Should Do

Amazon and TikTok’s collaboration is more than just a partnership — it signals the growing shift of e-commerce toward social commerce. For sellers, the takeaway is clear: move beyond listings and PPC alone, invest in content, and focus on community-driven engagement.

Revisit content marketing strategies with a focus on video, storytelling, and product presentation.

Track conversions from TikTok to measure campaign performance.

Treat TikTok as both a paid channel (ads) and an organic traffic source, leveraging viral potential for visibility.

News #5. Amazon to Remove Irrelevant Variation Themes Starting September

Between September 2 and November 30, 2025, Amazon will begin removing rarely used or irrelevant variation themes from listing templates. These themes are already flagged in Seller Central as “Deprecated: Do Not Use.” Any attempt to update listings with these outdated themes will result in an error.

What Sellers Will Need to Do

Amazon outlines a fairly manual process for compliance:

Delete the current parent ASIN.

Unlink child ASINs from that parent.

Create a new parent ASIN with a valid variation theme.

Reattach the child ASINs under the updated parent.

If sellers don’t complete these steps, child listings will remain active but will display individually, without being grouped into a variation set.

Why This Matters

Amazon frames the change as an effort to simplify listing creation, but sellers worry about the opposite. Removing familiar variation themes may make it harder to categorize products correctly and could break existing parent-child relationships. Rebuilding variations also risks triggering “variation abuse” flags, which may cause temporary sales drops.

What Sellers Should Do

Once again, Amazon’s “simplification” effectively shifts complexity to sellers. Brands with large product catalogs may be hit hardest, as losing properly structured variations can reduce visibility and negatively affect the shopping experience.

Audit current listings for any themes marked as Deprecated.

Prepare to rebuild variations using updated templates.

Use beta flat files with caution — sellers have reported errors when applying them.

Book a call now…

Book a call now…

Up to 45-min duration video-call

Topics we'll discuss:

| The next steps — there are two options

|