Amazon tightens review data access, reveals top global marketplaces, launches “Help Me Decide” AI shopping assistant, expands AWD network, and adds new dashboards and tools for sellers

This week Amazon doubles down on data control, AI, and logistics. Sellers lose open access to customer reviews but gain smarter dashboards, real-time analytics, and automation tools. Marketplace Pulse ranks the most promising Amazon regions, while new features like Help Me Decide, AWD expansion, and instant alerts show how fast the ecosystem is evolving.

News #1. Amazon Restricts Access to Customer Reviews for Third-Party

Recently, many Amazon sellers — including students from our own academy — noticed that popular analytics tools like Helium 10, Jungle Scout, Carbon6, and DataDive no longer display customer review data. After investigating, here’s what we found.

What changedAs of September 30, 2025, Amazon has officially removed the “Customer Reviews” section from Seller Central, replacing it with the Voice of the Customer (VoC) dashboard. Sellers can no longer view full lists of individual reviews — instead, they see aggregated insights, such as complaint categories, satisfaction levels, and suggested improvements.At the same time, Amazon strengthened its anti-scraping protections by updating its robots.txt file, adding CAPTCHA verification, and blocking IPs used for automated data collection. This effectively shut down direct review scraping for third-party tools.

Why it matters

While Amazon says the change aims to “make review analytics more useful,” it also limits transparency for sellers. They now see only summarized data, not specific customer comments. For third-party software like Helium 10 or Jungle Scout, this means a full algorithm redesign — tools must now rely on official APIs such as the Customer Feedback API and VoC interface instead of scraping web content.However, the SP-API does not provide access to actual review text, author details, dates, or individual star ratings. These remain visible on product pages but unavailable through any API or Seller Central interface.

What it means for Amazon sellersSellers lose the ability to perform deep, direct sentiment analysis or track how perception shifts over time through raw customer comments. This complicates brand reputation management, especially in competitive niches. On the other hand, VoC offers a safer, more structured way to identify recurring issues and quality trends — shifting focus from isolated reviews to systematic insights.For analytics platforms based on data scraping, these changes raise both costs and compliance risks. Amazon’s message is clear: all external tools must operate through official data channels, not workarounds.

TakeawayAmazon has fully closed off unrestricted access to customer review data. Sellers who want meaningful feedback will now have to adapt to the new VoC ecosystem and learn to interpret aggregated metrics instead of relying on raw review scraping.

News #2. Which Amazon Marketplace Has the Most Potential?

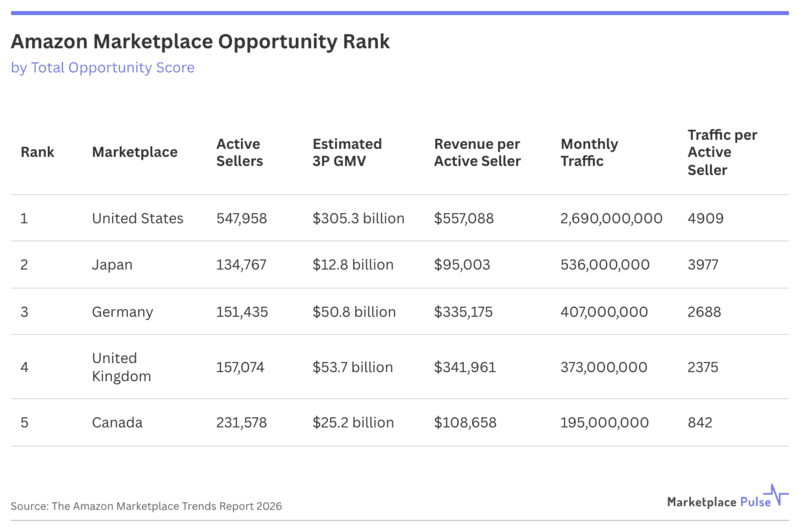

A new report from Marketplace Pulse analyzed 11 major Amazon marketplaces across seven key metrics — seller revenue, traffic, business stability, diversity, and growth rate among them. The findings show that marketplace potential isn’t defined solely by sales volume but also by how easily sellers can build a profitable and sustainable business.

The U.S. remains dominant, with 547,958 active sellers earning an average of $557,000 per year. Notably, 60% of new sellers make their first sale within a year — the highest conversion rate across all markets.

In second place, surprisingly, is Japan — a smaller market ($12.8 billion) but the most stable, where 15.5% of sellers have been active for more than five years.

Germany ranks third with an impressive $335,000 per-seller average revenue, though its complex regulatory environment limits entry.

Rounding out the top five are the U.K. and Canada, where success often depends on niche targeting and efficient optimization.Why it matters

The study challenges the long-held belief that profitability directly correlates with market size. Amazon is evolving into a multi-layered ecosystem, where stability, specialization, and local expertise can outweigh pure scale.What it means for Amazon sellers

Takeaway

The U.S. continues to offer the fastest path to growth, but Asian and European marketplaces present valuable opportunities for long-term stability and lower competition. For Private Label sellers, this is a clear signal to diversify — expanding beyond the U.S. into Japan, Germany, and Canada, where sustainable growth and consistent profits are increasingly achievable.

Marketplace Pulse’s analysis underscores a key trend: the future of Amazon selling belongs not just to those who scale fast, but to those who build strategically and diversify smartly across regions.

News #3. Amazon Launches AI Shopping Assistant “Help Me Decide”

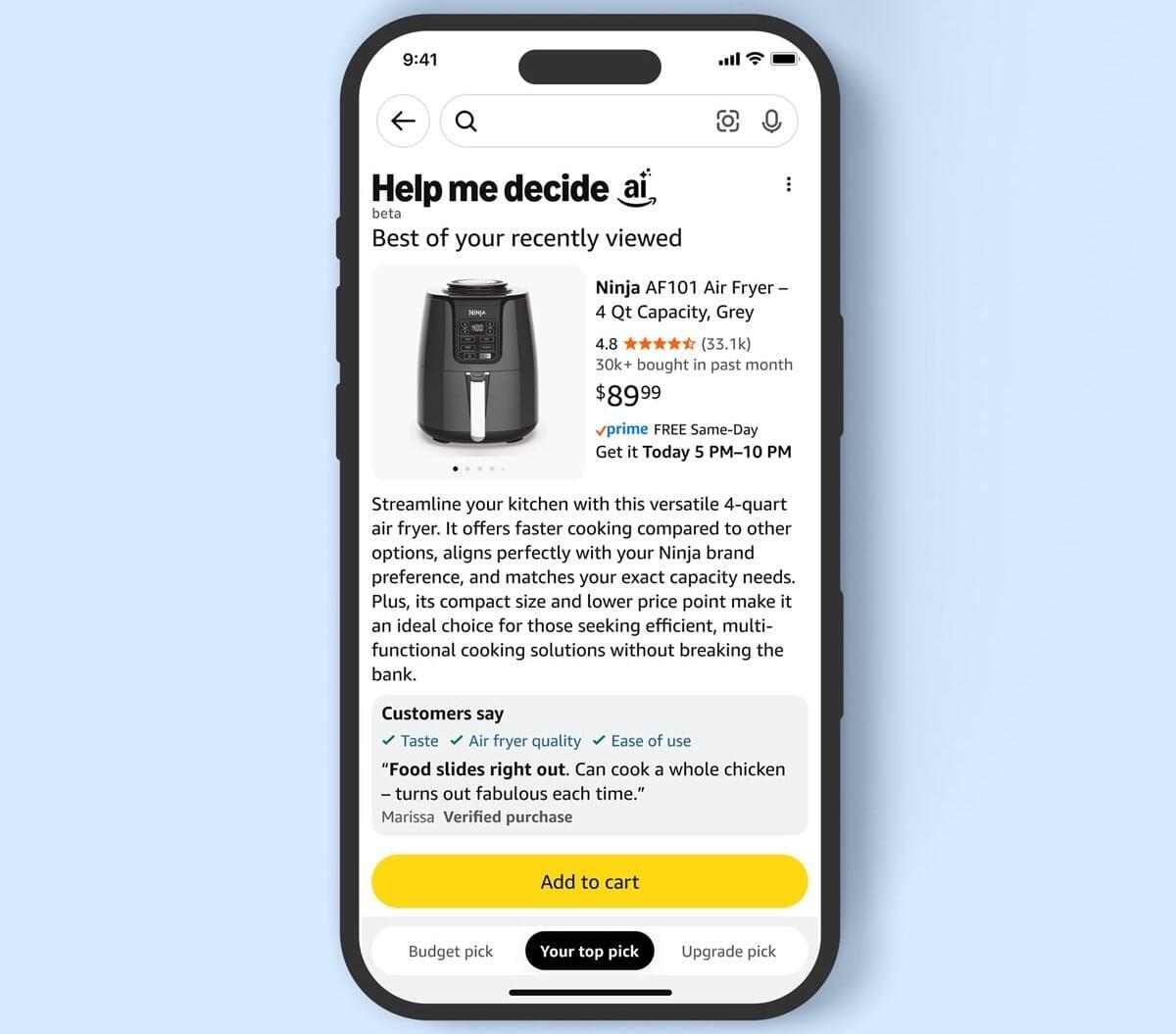

Amazon has introduced Help Me Decide, a new AI-powered feature designed to help shoppers make faster, more confident purchase decisions.

When a customer spends time browsing similar items, a “Help Me Decide” button appears on the product page. Clicking it generates a personalized recommendation, explaining why a particular product fits their needs — based on browsing behavior, purchase history, and preferences. The feature is currently available to U.S. customers.

Why it matters

The tool leverages Amazon’s in-house AI stack — Bedrock, SageMaker, and OpenSearch — to analyze user behavior and customer reviews in real time. It’s another step in Amazon’s strategy to build an AI-driven shopping ecosystem, following tools like Rufus (chat-based assistant), Interests (AI search by preferences), and Shopping Guides. But unlike previous features, Help Me Decide doesn’t just suggest — it makes a reasoned recommendation.What it means for Amazon sellers

This update could significantly change how products are discovered and promoted. Instead of relying on filters or rankings, Amazon’s AI will now recommend specific listings to individual shoppers. That means product content quality, images, and customer feedback will directly impact visibility and conversions.For sellers, optimizing listings for AI readability and trust signals — clear benefits, authentic reviews, and strong visuals — will become essential to secure placement in these personalized recommendations.

Takeaway

With Help Me Decide, Amazon is blurring the line between search and decision-making — ushering in a new phase where AI doesn’t just guide the purchase journey but actively shapes it.

News #4. Amazon Opens Two New AWD Centers in California and Arizona

Amazon has announced the opening of two new Amazon Warehousing and Distribution (AWD) centers on the U.S. West Coast — located in California and Arizona.

Designed for palletized shipments, the new facilities add another 12 million cubic feet of storage capacity to Amazon’s expanding AWD network. Sellers can now ship single-SKU pallets and floor-loaded inventory directly to these centers.

Why it matters

The new warehouses will help ease pressure on eastern regions and speed up inventory turnover for FBA-connected sellers. To encourage adoption, Amazon is running a limited-time promotion: until January 14, 2026, inbound shipments to the new AWD centers will be billed at $1 per box — down from the standard $1.35 rate.What it means for Amazon sellers

The new facilities are part of Amazon’s ongoing effort to strengthen the AWD infrastructure and cut storage costs for FBA sellers. By early 2026, mastering palletizable shipments could become a key operational advantage for brands scaling efficiently within the Amazon ecosystem.

For high-volume sellers and those dealing with uniform SKUs, this expansion presents a chance to reduce logistics costs and improve delivery speed on the West Coast. However, Amazon has issued a strict warning: shipments that don’t meet pallet requirements or include mixed SKUs will incur a $2.50 per-box penalty or may be rejected entirely.

Other Amazon Updates: MCF Analytics Dashboard, AI Listing Enhancer, and Instant Account Alerts

New Multi-Channel Fulfillment Dashboard

Amazon has launched the MCF Analytics Dashboard, giving sellers deeper insight into order performance. The tool displays total shipments, on-time delivery rates, fees, and time-based trends. It also includes SKU-level and cost reports, helping sellers track logistics efficiency and fulfillment expenses in real time.AI Tool to Enhance Product Listings

Push Notifications for Account Issues

Amazon introduced Enhance My Listing, an AI-powered assistant that analyzes product detail pages and suggests improvements to titles, descriptions, and attributes. Sellers can apply these edits with a single click to keep listings fresh and competitive. However, early testers on Amazon’s seller forums have raised concerns about the quality of AI-generated suggestions, noting that they often require manual review.

The Amazon Seller app now supports instant push notifications for critical events — including account health alerts, listing risks, payment errors, and suspensions. This feature helps sellers respond faster and stay informed about key account changes that could affect business continuity.

Book a call now…

Book a call now…

Up to 45-min duration video-call

Topics we'll discuss:

| The next steps — there are two options

|