Visual Search Lens Live, One-Product Millionaires, IP Risks, FBM Delivery Rules, Canada Re-Verification, and Tariff Refunds

This week’s Amazon seller updates cover both opportunities and risks. Amazon launches Lens Live visual search with Rufus integration, Marketplace Pulse highlights one-product millionaires, and IP complaints remain a growing threat. FBM sellers in the UK face stricter delivery standards, while Canadian accounts undergo surprise re-verifications. Plus: a possible path to recover Trump-era tariffs.

News #1. Amazon Rolls Out Lens Live: The Next Phase of Visual Search

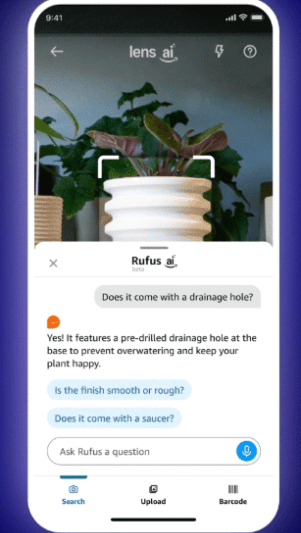

Amazon has launched Lens Live, an upgraded version of its visual search tool inside the Amazon Shopping app. With this new feature, shoppers can use their smartphone camera to scan items in real time and instantly see product suggestions displayed in a carousel at the bottom of the screen. From there, customers can add products directly to their cart or wish list without leaving camera mode.

A key innovation is the integration with Amazon’s AI assistant, Rufus. Lens Live now provides smart prompts, quick product descriptions, and contextual questions that help customers compare items on the spot. Shoppers can even ask clarifying questions directly through the camera interface and get instant answers.

Availability: The feature is currently rolling out to select iOS and Android users in the U.S. and will be available to all American customers in the coming months. Traditional Lens functions—such as uploading a photo, barcode scanning, and image search—remain fully supported.

Technology behind Lens Live: The system combines AWS OpenSearch and SageMaker for large-scale model deployment, while on-device computer vision recognizes objects in real time and matches them against Amazon’s product catalog. The Rufus LLM powers conversational hints and quick feature comparisons.

What this means for Amazon sellers

Lens Live moves shopping closer to a “see it, buy it” experience, where a product spotted in real life or on social media can immediately be found on Amazon. This shift heightens the importance of high-quality images and strong visual branding. Sellers who invest in professional photos, clear positioning, and engaging visuals will be better positioned to capture impulse-driven sales.

News #2. $1 Million from a Single SKU: A Rare but Telling Amazon Phenomenon

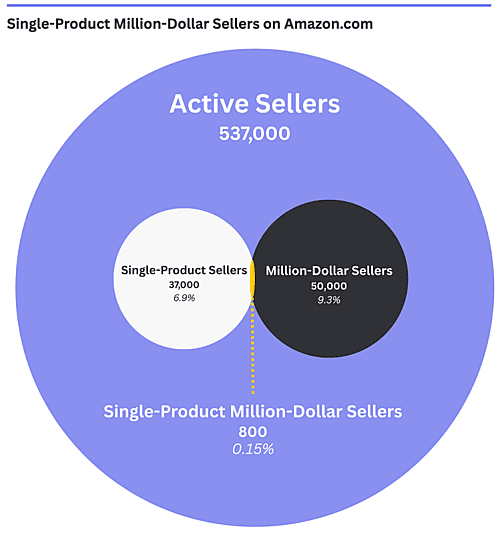

According to new research from Marketplace Pulse, more than 800 Amazon sellers generate over $1 million in annual revenue from a single product. Among them, 19 companies have pushed their sales past $10 million with just one SKU. For context, Amazon’s U.S. marketplace has about 50,000 sellers making seven figures, and only 1.6% of them rely on a one-product model.

A notable success story is Hero Cosmetics, which started with just one product—the Mighty Patch acne patch. The SKU quickly rose to the top of Amazon’s Beauty category, paving the way for product expansion, retail partnerships with Target and Ulta, and ultimately the company’s $630 million acquisition.

Pros of the one-product model: maximum focus on resources, simplified operations, and the potential to scale massively with minimal catalog complexity.

Cons: extreme vulnerability. Algorithm changes, competitor moves, or supply chain disruptions can threaten the entire business. That’s why nearly 500 of the 800 “single-SKU millionaires” sit in the $1–2 million revenue range, where sellers often face a critical choice: diversify or risk decline.Some sellers adopt a hybrid approach, balancing one top-performing SKU sold as a third-party (3P) seller with additional products offered directly to Amazon as a first-party (1P) vendor, mitigating revenue risk.

Interestingly, about 75% of these companies are based in China, benefiting from proximity to manufacturing, government export support, and strong knowledge of Amazon’s algorithms.

What this means for Amazon sellers

The rise of “single-SKU millionaires” highlights both the opportunities and risks of hyper-focus. With Amazon’s massive traffic, one well-optimized product can become a full-fledged business. However, long-term success often requires smart risk management and timely diversification.

News #3. IP Complaints on Amazon: Rising Risks for Sellers

A growing number of sellers are facing intellectual property (IP) complaints on Amazon, according to recent research from SellerApp. These complaints can lead not only to individual ASIN suspensions, but also to lower Account Health scores, frozen disbursements, and in severe cases, full account deactivation.

How it works

Complaints are typically filed by brands, their agents, or even competitors, and usually fall into three categories:

Trademark use (names, slogans, logos)

Unauthorized use of images or marketing materials

Alleged patent infringement

Amazon takes an uncompromising approach: once a complaint is filed, the ASIN is immediately blocked without investigation. The burden of proof lies entirely with the seller.

The “Unofficial IP Complaint List”

Amazon does not publish a list of brands prone to filing IP claims. However, experienced sellers share their own databases across forums, Facebook groups, Discord, and Reddit. These lists track:

Which ASINs were suspended

Which brands frequently submit claims

Type of violation (trademark, copyright, patent)

Outcomes — whether claims were resolved or ignored

Well-known brands like Nike, Apple, Disney, LEGO, and Hasbro are notorious for their zero-tolerance stance toward third-party sellers.

Who is most at risk

Online arbitrage and wholesale sellers: Even buying from an authorized distributor doesn’t guarantee you the right to sell on Amazon. Many major brands file automatic claims to protect their distribution.

Private label brands: Risks often stem from branding choices. A poorly chosen name, packaging design, or logo can trigger complaints.

Why this matters

Not all complaints are genuine — competitors and aggregators are increasingly using IP claims as a weapon to remove rivals from search results.What sellers should do

What this means for Amazon sellers

Monitor Account Health → Policy Compliance daily.

Build your own “risk list” of brands prone to filing claims.

For private label: vet names, logos, and designs through USPTO and Google Patents.

For arbitrage/wholesale: source only from authorized distributors and keep all documentation.

If a claim is filed: act quickly — contact the complainant, remove the listing, and submit a Plan of Action.

IP complaints have become a critical risk factor on the marketplace. For arbitrage sellers, it’s a warning to be more selective with brands. For private label sellers, it’s a push to build truly original products. In both cases, prevention is far more effective than damage control.

News #4. UK FBM Sellers Face Stricter Delivery Standards

Amazon has announced new delivery performance requirements for FBM (Fulfilled by Merchant) sellers in the UK. Starting September 16, 2025, merchants will be required to maintain an On-Time Delivery Rate (OTDR) of at least 90%.

What is OTDR?

OTDR measures the percentage of orders delivered by the promised delivery date. Falling below the 90% threshold can lead to listing suspensions or restrictions on FBM sales beginning in 2026.Rollout timeline:

September 2025 — OTDR metric appears in Account Health.

October 2025 — non-compliance warnings begin.

January 19, 2026 — maximum transit time for UK orders reduced from 5 to 4 days.

February 2, 2026 — sanctions officially take effect.

Tools Amazon provides:

Automated Handling Time (AHT): dynamically adjusts handling times at the SKU level.

Shipping Settings Automation (SSA): calculates delivery times using carrier performance data.

Buy Shipping: protects OTDR when using Amazon-purchased labels.

If sellers use SSA and Buy Shipping with a handling time of 0–1 days, carrier delays won’t count against OTDR.

Seller concerns:

Many argue it’s unfair to penalize merchants for courier delays or weather disruptions.

Northern Ireland shipments remain a gray area, as customs delays can exceed 16 days.

Some sellers see the policy as added pressure to shift to Fulfillment by Amazon (FBA).

What this means for Amazon sellersAmazon is raising the bar for FBM logistics in the UK. Sellers will need to optimize carriers, track shipments carefully, keep proof of dispatch, and adopt automation tools to stay compliant. For those unable to meet the standard, moving more inventory into FBA may become the only viable option.

News #5. Amazon Canada Demands Re-Verification — Without Clear Guidance

In recent weeks, more and more sellers on Amazon forums have reported unexpected re-verification requests from Amazon.ca — even for accounts that were registered and successfully verified years ago.

What’s happening?

Amazon Canada is asking sellers to upload additional documents. The problem: submissions are often rejected with vague responses like “does not meet requirements”, leaving sellers unsure of what exactly is missing or incorrect.The “Company registration extract” confusion

One of the terms used in Amazon’s requests is “Company registration extract.” This document doesn’t officially exist for U.S.-based companies, creating further complications. Some sellers have managed to pass the review by submitting IRS Form 147C (an IRS-issued letter confirming EIN and business address), though support rarely confirms whether it’s accepted — the verification banner simply disappears.Why this matters — even if you don’t sell in Canada

Sellers with a North America Unified Account are automatically connected to Amazon.ca. That means verification requests can arrive even if you have no sales or plans to operate in Canada. Ignoring them is risky: Amazon may suspend all linked accounts — including your primary U.S. account — if one region is flagged as non-compliant.What sellers should do

For many sellers, the lack of transparency around these requests is the biggest frustration. Until Amazon clarifies its documentation standards, sellers should be proactive in monitoring their account health across all regions.

Check that your Canadian account is marked as “verified”, even if you’re not actively using it.

Submit IRS Form 147C, which has worked for some sellers.

If documents are rejected, open a case and request clarification on what exactly failed.

Consider setting Amazon.ca to Vacation Mode temporarily to avoid unintended activity.

News #6. Can Importers Recover Overpaid Tariffs?

As legal battles continue over the Trump-era tariffs, U.S. importers may have a chance to reclaim duties they’ve already paid — or at least a portion of them. According to EcomCrew, financial firms are now offering to purchase rights to potential refunds, paying importers 20–30% of the expected return if courts ultimately rule the tariffs unlawful.

The catch: to preserve the right to a refund, importers must file a protest within 180 days of liquidation (the official closing of an import entry by U.S. Customs). Missing this deadline makes refunds impossible, even if tariffs are overturned later.

Legal experts note that protests can be filed for multiple reasons — from errors in product classification to improper application of overlapping duties.

What importers should do now:

Bottom line: tariff refunds represent a significant recovery opportunity but demand accuracy, legal preparation, and strict adherence to deadlines. Selling refund rights is an option, but it comes with a steep discount.

Review customs records in the ACE system.

Confirm liquidation dates for all shipments.

File protests on disputed tariffs as soon as possible.

Consider filing a case with the Court of International Trade if CBP rejects the protest.

Other Amazon News

Seasonal Sales Prep Reminder for Sellers

Amazon has issued a reminder to sellers that the current and upcoming shopping seasons remain some of the most important growth opportunities of the year.

Back-to-School: The season is winding down, but the Back-to-School Shop will remain active through the end of September. Eligible items tied to the theme can still be featured.

Halloween: The Halloween Shop is already live and will run until late October. Top categories include costumes, party supplies, décor, candy, and cosmetics.

Holiday Season: Running September through December, this period peaks around Thanksgiving, Black Friday, and Cyber Monday. Categories like toys, apparel, footwear, jewelry, beauty, and electronics see the biggest surges.

New Year, New You: Launching mid-December through January, this campaign spotlights fitness, wellness, and health-related products.

Amazon’s recommendations for sellers:

Why it matters for sellers

Keep bestsellers in stock.

Add seasonal keywords to titles and descriptions.

Refresh product images to align with holiday themes.

Use coupons and promotions to boost visibility.

Amazon is signaling that seasonal readiness goes beyond inventory levels. Success depends on optimizing listings, tailoring content for seasonal demand, and timing promotions strategically. For many sellers, Q4 performance will hinge on how quickly they adapt to these seasonal shifts.

Book a call now…

Book a call now…

Up to 45-min duration video-call

Topics we'll discuss:

| The next steps — there are two options

|