Amazon AI vs Shopify AI: Strategies Compared, 2D Barcode Push, De Minimis Tariff Fallout, and Virtual Bundle Growths

This week’s Amazon news highlights how AI is reshaping e-commerce. Amazon and Shopify pursue very different AI strategies, with Amazon focusing on supply chains and Shopify on seller growth. Amazon accelerates the adoption of 2D barcodes ahead of GS1 Sunrise 2027, while new US tariff rules eliminate the de minimis exemption, impacting holiday pricing. Plus: Seller Labs shows why Virtual Bundles are now a strategic tool, and Amazon rolls out fresh updates to FBA, MCF, and Outlet.

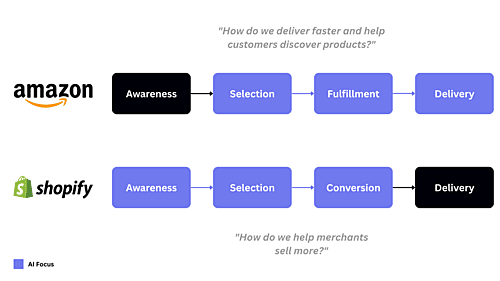

News #1. Amazon AI vs. Shopify AI: Two Competing Visions for the Future of E-Commerce

Marketplace Pulse analysts recently published a study comparing how Amazon and Shopify are deploying artificial intelligence. The findings reveal two very different strategies shaping the future of online retail.

Amazon’s supply-centric AI is focused on optimizing supply chains and streamlining the customer experience:

DeepFleet: AI-driven system managing over 1 million warehouse robots.

Demand forecasting with weather and local event data, boosting accuracy by 10–20%.

Wellspring: a generative AI platform that identifies optimal delivery hubs using satellite maps.

Alexa+ and Rufus: consumer-facing AI tools already integrated into daily shopping journeys.

Shopify’s demand-centric AI, on the other hand, is built entirely around helping merchants grow sales. Under its Shopify Magic brand, the platform provides AI tools for product descriptions, email campaigns, marketing content, and Sidekick — a virtual assistant for store management.

The philosophies diverge:

Amazon views sellers as a source of limitless product selection and channels AI into making its retail ecosystem more efficient.

Shopify earns only when its merchants succeed, so its AI investments are entirely seller-first.

Financial results underline this difference:

In short, Amazon is doubling down on building the infrastructure of global retail, while Shopify strengthens its position as the go-to platform for independent sellers.

Amazon posted $167.7B in Q2 2025 revenue (+31% YoY), with operating income rising by $19.2B thanks to AI-driven efficiency gains.

Shopify reported $2.68B (+31% YoY), with merchant services accounting for 76% of revenue.

News #2. Amazon Accelerates Push Toward 2D Barcodes Ahead of GS1 Sunrise 2027

Amazon is moving steadily toward the adoption of 2D barcodes, which will become the global GS1 standard by the end of 2027. According to Carbon6 experts, this shift — known as Sunrise 2027 — will require all retailers to upgrade their POS systems to read both traditional UPCs and two-dimensional codes.

Unlike standard UPCs, 2D codes (such as Data Matrix and QR) can store far more data, including:

GTIN (Global Trade Item Number),

batch and serial numbers,

expiration dates,

authentication details through Amazon Transparency.

For sellers, this means greater supply chain visibility, but also stricter requirements for labeling and logistics.

What’s already live in Seller Central:

2D barcodes can now be used in the Send to Amazon workflow. Codes on cartons include the Shipment ID, ASIN or UPC, and product quantities, making inbound receiving faster and less error-prone.

Instead of manually entering case pack details in Seller Central, sellers or suppliers can generate a 2D code that instantly transmits shipment, product, and unit count data.

Importantly, 2D codes do not replace shipping labels — they are applied in addition. Errors in encoded data can lead to shipment blocks.

Background: Amazon first introduced 2D Data Matrix codes in 2017 through its Transparency program, aimed at brand protection and anti-counterfeiting.

Amazon isn’t waiting for the official 2027 deadline. By rolling out 2D functionality early, the marketplace is nudging sellers to adopt the standard now. For brands, it’s not only about compliance but also about building customer trust and safeguarding products from fakes. While mandatory adoption timelines haven’t been published, UPCs and 2D codes will likely coexist during the transition phase.

News #3. The End of De Minimis: How New Tariffs Will Reshape Holiday Pricing and Sales

As of August 29, 2025, the U.S. has officially eliminated the de minimis rule, which previously allowed imports valued under $800 to enter duty-free. Now every shipment is subject to tariffs — and sellers and shoppers alike will feel the effects as we head into the peak holiday season.

What experts predict:

Higher import costs will squeeze margins for international and cross-border sellers.

Consumers may shift away from big-name brands toward cheaper alternatives, including private labels.

Retailers may either pass costs on to customers or discontinue unprofitable SKUs.

Major brands like Under Armour already project significant profit losses from tariffs.

Early signs on Amazon:

Nearly 50% of suppliers report raising prices by 5–10%.

Toys and games (60% of sellers) and electronics (50%) are the hardest hit categories.

Goods from China rose 2.6% between January and June, home products climbed 3.5%, and some subcategories — like cookware — spiked by 50% or more.

Consumer behavior shifts:

What this means for Amazon sellers:

84% of U.S. shoppers now rank price over quality or variety. More than half are cutting discretionary purchases or switching to generics. As analyst John Harmon put it, “Consumers will find a way to get goods for the holiday” — but their dollars are increasingly flowing toward budget-friendly options.

Competition is getting tougher, and pricing strategy is becoming mission-critical. To stay profitable, sellers must sharpen product positioning, run smarter promotions, and maintain tight control over landed costs — or risk losing sales in Q4’s most important weeks.

News #4. Seller Labs: Virtual Bundles Are Becoming a Strategic Tool for Amazon Sellers

In its latest report, Seller Labs highlights that Amazon’s Virtual Bundles, first introduced in 2020, are taking on new strategic importance in 2025. More sellers are leveraging bundles not only to boost average order value (AOV) but also to drive incremental sales and strengthen brand positioning.

How Virtual Bundles work:

Sellers can combine two or more products from the same brand into a “bundle” without creating a new SKU.

Amazon manages fulfillment — each item remains in inventory as an individual ASIN, but customers receive them together in a single shipment.

The bundle gets its own product detail page with a unique title, description, and images.

Why this matters:

Bundles help brands capture more real estate in search results, showing multiple offers in parallel.

They increase AOV, as customers are more likely to purchase a bundle than a single item.

Bundles serve as a cross-selling tool, giving brands an edge against competitors on their own product pages.

Best practices recommended by Seller Labs:

Seller Labs emphasizes that in 2025, Virtual Bundles are no longer just a clever marketing trick — they are a cost-effective way to grow sales without extra ad spend or logistical complexity.

Test different product combinations and track which bundles drive the most clicks and conversions.

Bundle items that complement each other naturally, rather than forcing random pairings.

Use bundles to promote new or seasonal items by pairing them with established bestsellers.

Other Amazon News

FBA Opportunities Now Integrated into Manage All Inventory

Amazon has embedded FBA Enrollment Opportunities directly into the Manage All Inventory dashboard. Sellers in the US, Europe, and Japan can now view up to 50 daily refreshed recommendations, including sales history, conversion rates, and Featured Offer eligibility. With a single click, you can convert an item to FBA or create a new FBA offer.

Delivery Photos Now Available for MCF Orders

For Multi-Channel Fulfillment (MCF) orders shipped via Amazon Logistics, sellers can now provide buyers with delivery photos for added transparency. Photos can be automatically shared through Swiship (when buyer email is included) or sent manually via a tracking link. They are also accessible via the Selling Partner API. Note: only high-quality images that meet Amazon’s standards will be accepted.

Amazon Outlet: Clear Slow-Moving Inventory Before Holiday Season

Amazon is reminding sellers about the benefits of Amazon Outlet for liquidating slow-moving products ahead of peak shopping season. Requirements include a Professional selling plan, an overall customer rating of at least 4 stars, and eligible inventory.

Steps to create an Outlet deal:

Amazon emphasizes that Outlet deals help free up storage space for bestsellers, ensuring sellers are ready for high-demand Q4 events.

Go to Inventory → FBA Inventory.

In filters, select Recommendation → Create outlet deal.

Under Recommended action, click Create outlet deal.

Review the suggested Outlet price (must be equal to or below the maximum allowed).

Submit for review.

Book a call now…

Book a call now…

Up to 45-min duration video-call

Topics we'll discuss:

| The next steps — there are two options

|