AI agents clash with Amazon, GenAI reshapes shopping, Chinese sellers take majority, and new B2B fee cuts for FBA

This week’s Amazon news highlights major shifts shaping e-commerce. Amazon is blocking third-party AI agents while Walmart and Target embrace them, raising questions about the future of agentic commerce. GenAI adoption is changing how Americans shop, Chinese sellers have now surpassed 50% of all Amazon merchants worldwide, and Amazon introduces lower FBA fees for bulk B2B orders.

News #1. Amazon Blocks AI Shopping Agents While Walmart and Target Open the Door

A recent post by expert Chris Jones reignited debate in the Amazon seller community about agentic commerce — an emerging model where AI assistants, not people, complete online purchases.

The findings reveal a sharp divide. Walmart and Target are leaning in, offering API access and allowing automated transactions. Amazon, on the other hand, is taking the opposite stance — blocking AI bot traffic and preventing third-party agents from fully accessing its ecosystem.

According to ppc.land, the logic is clear: Amazon is building its own closed-loop AI shopping model, powered by Rufus and Alexa. By keeping decision-making inside its ecosystem, Amazon ensures total control of the customer journey. The same pattern shows up in its seller tools — new AI features are launching quickly, but always within Amazon’s walled garden.

Why this matters for sellers:

In short, Amazon is building a tightly controlled ecosystem where innovations only work inside its walls. For sellers, this creates both new opportunities — via Amazon’s own AI tools — and added risks, as dependence on the marketplace grows deeper.

New competition channel. If Walmart and Target continue enabling open APIs, sellers could soon reach customers through third-party AI assistants.

Amazon centralizes power. Any buyer-side automation on Amazon will be mediated by Rufus or internal tools, limiting flexibility and giving Amazon more control over pricing and selection.

First-mover advantage. If agentic commerce becomes mainstream, sellers who adapt early could gain a strategic edge.

News #2. Nearly 60% of Americans Use AI for Online Shopping — ChatGPT Often Beats Google

A new survey by Omnisend (August 2025) shows a major shift in consumer habits: nearly 60% of U.S. shoppers now use generative AI tools to research products and prepare for purchases. Even more striking, one in four respondents said they prefer ChatGPT over Google for product discovery.

Key insights from the survey:

42% use AI to explore new product ideas.

37% rely on it to compare features and prices.

28% turn to AI for writing or reading reviews.

25% believe ChatGPT is more effective than Google for shopping decisions.

Why it matters

Shopping behavior is evolving. Instead of relying solely on Google or Amazon Search, more buyers are turning to AI assistants. This shift shapes what products customers see — and which brands they trust.What it means for Amazon sellers

Optimize product listings not only for Amazon Search but also for AI algorithms that aggregate and analyze product data.

Strong reviews and high-quality content increase the chances of being recommended by AI tools.

Competition is moving toward sellers who can position themselves effectively within the broader AI-driven ecosystem.

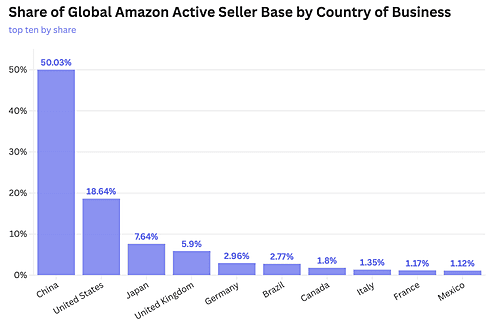

News #3. Chinese Sellers Surpass 50% on Global Amazon Marketplaces

A new report from Marketplace Pulse marks a historic milestone: in 2025, Chinese sellers now represent more than half of all global Amazon sellers — with the sole exception of Japan. Just a few years ago, many expected the balance to hold, but the surge of new accounts from China continues to outpace growth from Western merchants.

Key findings from the study:

On Amazon.com (U.S.), Chinese sellers account for roughly 45%.

In Europe (Germany, France, the U.K.) and across Asia, the share is even higher.

Many Chinese sellers rely on Private Label and D2C models, combining competitive pricing with direct control over manufacturing.

Among Amazon’s top 20 global sellers, more than half are now China-based companies.

Why it matters for the market

China’s dominance is no longer just about low costs. Chinese brands are mastering marketing, adopting AI tools, and building global recognition — examples include Anker, Shein, and Aukey. Meanwhile, Western sellers face rising costs and mounting pressure, making it harder to keep pace.What it means for Amazon sellers

Local sellers may still find an edge in niches where delivery speed and consumer trust are critical, but the mass market is increasingly shifting toward Chinese players.

Competition from Chinese merchants is intensifying, especially in low- and mid-priced categories.

Western sellers must differentiate through branding, quality, and unique product design.

News #4. Amazon Cuts FBA Fees for B2B Orders with Bulk Discounts

Starting September 24, 2025, Amazon introduced a new fee discount on Fulfillment by Amazon (FBA) for Amazon Business orders. To qualify, sellers must set a business price or apply a quantity discount of at least 3%. The move is aimed at encouraging more B2B sales on the marketplace.

What’s changed:

Reduced FBA fulfillment fees now apply to Amazon Business orders with bulk discounts ≥3%.

Discounts are exclusive to B2B transactions.

Sellers gain access to Amazon Business’s customer base of over 8 million companies, who typically place larger orders and return products less often than retail shoppers.

Why it matters

Amazon Business remains an underutilized channel for many sellers. For private label and wholesale businesses, B2B offers opportunities to:What it means for Amazon sellers

Sell in larger volumes,

Lower return and logistics costs,

Build relationships with corporate buyers, including SMBs.

This update gives sellers a fresh incentive to engage with Amazon Business. It’s particularly beneficial for fast-moving, high-demand products where corporate buyers are consistent. However, before adjusting pricing, sellers should carefully recalculate margins — the new fee structure may not be profitable for mid- and high-ticket products, where discounts could outweigh the benefits.

Book a call now…

Book a call now…

Up to 45-min duration video-call

Topics we'll discuss:

| The next steps — there are two options

|