Introduction

Almost every newcomer considering a business on Amazon runs into the same obstacle: uncertainty. The idea is there, motivation is strong—but then chaos sets in. Millions of listings, aggressive competitors, established brands with years of reviews and sales history. The core question sounds simple, yet it stops most people cold: what if I choose the wrong product and lose money?

For years, this fear was the main barrier to entry. Launching a product felt like an expensive gamble where luck often mattered more than strategy. Recently, however, Amazon has taken several strategic steps that changed this equation. Paradoxically, even as competition intensifies and requirements become stricter, bringing a new product to Amazon today is safer and more predictable than it was just a few years ago—especially for new sellers and private-label brands planning their first launch in 2026.

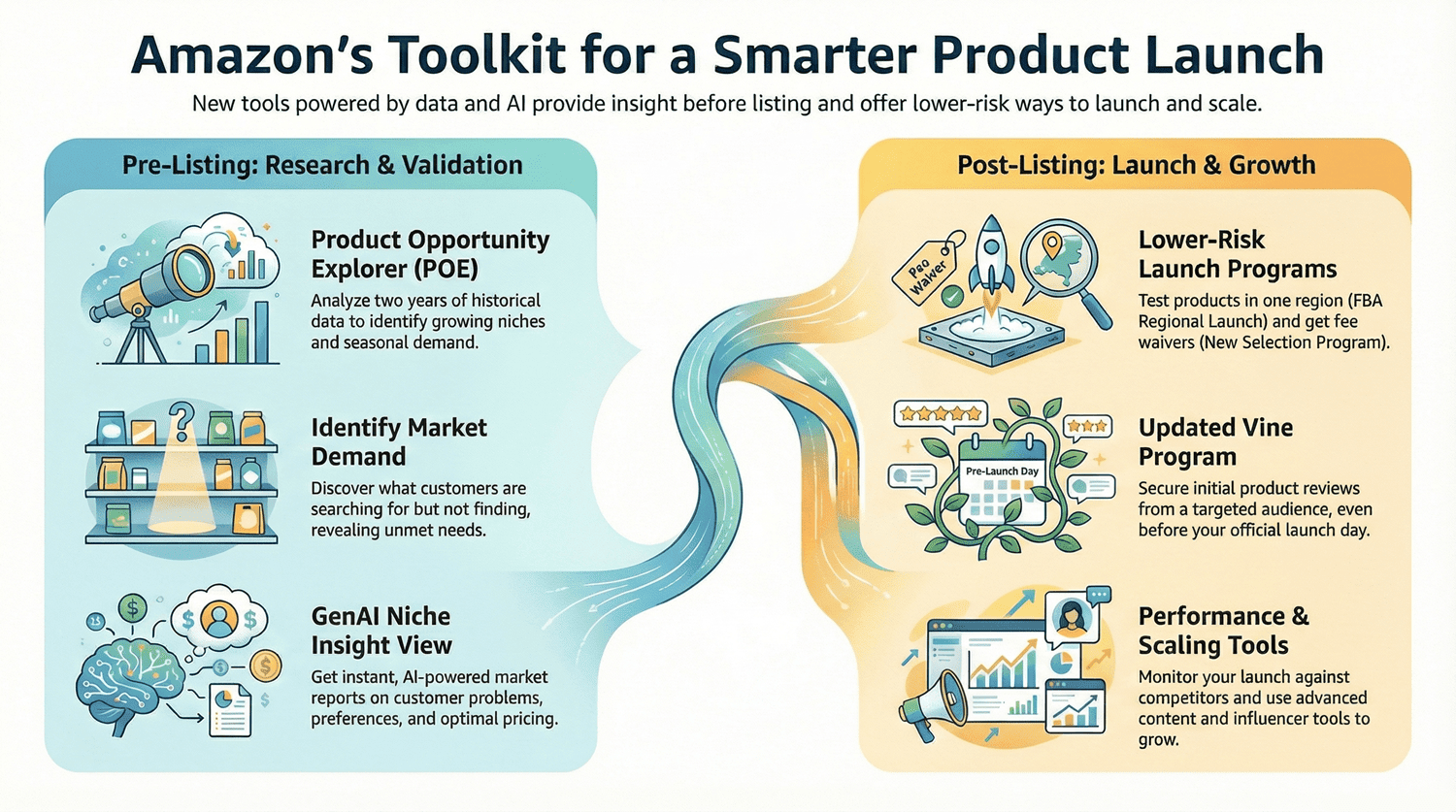

The explanation lies in a new generation of tools and programs built directly into Amazon’s ecosystem. Most of them were officially unveiled and explained in depth at Amazon Accelerate 2025 last fall. Amazon’s intent is clear: turn product launches from a lottery into a structured, data-driven process based on internal insights, testing, and controlled scaling. Below, we break down why entry barriers are lower today—and how the new launch logic works, from idea to sustainable growth.Pre-listing: How to Validate Product Demand Before You Invest

Historically, the hardest part of selling on Amazon wasn’t marketing or logistics—it was choosing the right product. Sellers studied bestsellers, analyzed competitors, and tried to guess where there might still be room to enter. The problem is that the catalog reflects the past. It shows decisions other sellers have already made, not emerging or unmet customer needs. Yet a successful launch requires looking ahead.

This is exactly the blind spot Amazon began addressing with the updated Product Opportunity Explorer, available in Seller Central. Over the past year, the tool has evolved significantly. It now goes beyond current market size, offering up to two years of demand history, seasonality patterns, and shifts in competitive intensity. Instead of a static snapshot, sellers can see where a niche is heading—growing, plateauing, or gradually fading.

Another major advantage is geographic expansion. Product Opportunity Explorer now covers 11 additional countries, including Mexico, Brazil, Canada, Australia, the Netherlands, Singapore, and others. This allows sellers to think about international scaling before the first unit is ever launched, identifying markets where demand exists and competition remains manageable.

The most important shift, however, is the Identify Market Demand feature inside POE. For the first time, Amazon highlights not only what is selling, but what shoppers actively search for and fail to find. These are queries with clear interest and clicks but weak conversion—a direct signal of unmet demand. For beginners, this changes the game. Instead of competing head-to-head with category leaders, sellers can enter niches where customer problems remain unsolved.

The next logical step is AI. The GenAI Niche Insight View, currently in beta, automates what once took hours of manual analysis. It processes reviews, shopping behavior, and pricing data to produce a clear picture of a niche: key pain points, must-have features, and acceptable price ranges. In practice, sellers receive a concise market research snapshot in minutes. This is not just faster analysis—it’s a shift in how products are designed from day one.Post-listing: Low-Risk Launches and Controlled Scaling on Amazon

Even with a solid idea, product launches traditionally involved major risks: how much inventory to order, where to send it, and how to survive the early months without reviews. Amazon now offers concrete answers to these challenges.

FBA Regional Launch allows sellers to send inventory to a single region instead of nationwide distribution. This turns the launch into a controlled pilot: smaller batches, faster delivery, and a reliable signal of demand. If the product underperforms, losses remain limited. If it succeeds, scaling becomes a deliberate next step rather than a leap of faith.

This model is reinforced by the New Selection Program, which supports new listings financially. Amazon shares part of the early risk by offering fee rebates, discounted storage, and free removal of initial inventory. For sellers with limited capital, this makes demand testing far more accessible.

The updated Vine program also plays a different role today. While long familiar to sellers, it is now powered by AI that selects reviewers closely aligned with the product’s target audience. More importantly, Vine can be activated before sales begin. As a result, a listing can enter search already carrying reviews and ratings—an advantage that was previously out of reach for most new brands.

Once a product is live, the next question is whether it’s moving in the right direction. Amazon is preparing to roll out Product Performance Spotlight, a new dashboard designed as a control center for listings. It will highlight competitive benchmarks, weak points, and practical recommendations for next steps.

As traction builds, sellers move into the growth phase. One powerful channel is Amazon Business, which opens access to corporate buyers such as schools, offices, and workshops. These customers buy in volume and reorder regularly, meaning a single successful placement can evolve into a stable revenue stream.

International expansion naturally follows. Thanks to the broader reach of Product Opportunity Explorer, it’s easier to see where demand outpaces competition. Products that perform well in one market often translate successfully to Canada, Mexico, or across Europe.

Another growth lever is Creator Connections, which directly links brands with influencers capable of generating rapid awareness. In categories like apparel, beauty, or home goods, one well-executed video can outperform traditional advertising.

This strategy is further supported by the Brand Referral Bonus, which refunds part of Amazon’s commission when sellers bring in external traffic. Influencer campaigns, social media, and owned websites become not only effective, but economically sound.

Finally, one of the most impactful innovations is Shoppable A+ Content. A+ pages now function as mini storefronts, featuring clickable galleries of other products within the brand. This creates strong upsell opportunities and increases average order value. For brands with a product line, customers remain within the ecosystem, moving seamlessly from one item to the next.Conclusion

Amazon is steadily transforming product launches into a structured, flexible process where sellers can test ideas, make faster decisions, and manage risk. AI is no longer a decorative add-on—it sits at the core of this system, replacing guesswork with data and manual analysis with clear signals.

Taken together, these changes redefine how new products are launched on Amazon in 2026: data replaces intuition, testing replaces blind investment, and AI replaces endless spreadsheets.

Yes, the rules are stricter, competition is tougher, and buyers are more demanding. Yet the paradox remains: launching new products is still easier today than it was several years ago. Not because the market softened, but because Amazon’s tools directly address the fears that once held newcomers back.

Where product selection once felt like guesswork, sellers now see real, unmet demand. Where testing required large inventory bets, regional launches allow precise validation. Reviews—once a major hurdle—can now appear before sales begin through Vine. And complex analytics that used to live in massive tables are now delivered by AI in clear, actionable language.

The result is a launch process that no longer feels like a jump into the unknown. There is a roadmap, guidance, and support at every stage. And if you’ve been thinking about your first product for a long time, this may be the moment when entering Amazon is finally as transparent and controlled as it gets.Book a call now…

Book a call now…

Up to 45-min duration video-call

Topics we'll discuss:

| The next steps — there are two options

|