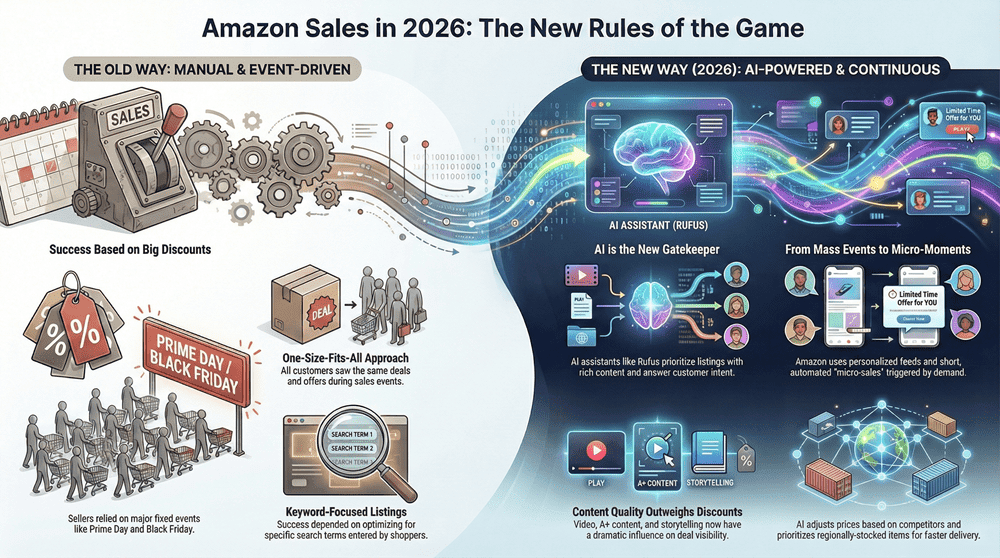

Amazon is reshaping its sales strategy for 2026, shifting from fixed mega-events to a continuous cycle of personalized, AI-driven shopping moments. Micro-sales, dynamic pricing, and regional customization are becoming standard.

This guide explains what’s changing, how the new sales calendar works, and what sellers must prepare for to stay competitive.

Introduction

Not long ago, participating in Amazon sales events was almost a formality: set a discount, bump up bids — and orders flowed in. In 2026, things are different. Amazon is completely reworking the mechanics of sales: they are becoming data-driven, personalized, and powered by AI. Success now depends less on price alone and more on how well your product is understood by Amazon’s algorithms, how strong your content is, and how prepared your brand is to play by the platform’s new rules.

In this article, we explore the changes ahead for sellers in 2026 — and show how to use them to preserve margin and boost profits.1. Sales Events Are Now Data-Driven

The period 2025–2026 marks a turning point for Amazon’s entire ecosystem. The platform is moving away from major fixed events like Prime Day. Instead, every sale is part of a continuous, intelligent promotion cycle.

Amazon is introducing:

Micro-sales — short six-hour promotions that trigger automatically when interest surges in a certain category,

Personalized offer feeds — custom deals tailored for each user,

AI-managed traffic — visibility and ad placements updated in real time based on demand and buyer behavior.

2. Meet the New Generation of Buyers

It’s not only Amazon that’s changing — buyers are changing too. Modern shoppers respond not to banner ads, but to content, social proof, videos, app interfaces like TikTok, and assistant-driven recommendations from tools such as Alexa or Rufus.

More and more often, a user doesn’t manually search — they simply ask: “Alexa, find the best wireless earbuds.”

In response, Amazon now delivers results based on user intent, not just keywords. This shift has already shown results: according to a report from SellerApp, Gross Merchandise Value (GMV) during Amazon sales periods grew more than 20% from 2023 to 2025, despite overall retail slowdown.

Tip for sellers: Increase your product’s perceived value. Improve its quality and features. Optimize listing copy for natural language, answer likely customer questions in detail, and add FAQ blocks. This helps Rufus and Amazon’s AI “understand” your item better.3. From Big Events to Micro-Events

Alongside traditional occurrences such as Prime Day and Black Friday, Amazon now runs Micro-Sales — short, six-hour discounts activated automatically when demand spikes in a category.

For example, if searches for “smart desk lamp” increase by 30%, the system triggers a temporary micro-sale in that subcategory. Sellers don’t need to lift a finger — as long as their listing is well-optimized and inventory is ready.

Takeaway: To benefit from Micro-Sales, keep your listings up-to-date, maintain strong stock levels, and ensure your content meets Amazon’s standards. The algorithm will ignore listings with weak content or insufficient inventory.4. Regional Personalization and Dynamic Discounts

Another key change: Amazon now tailors deals to regions based on local demand, inventory levels, and buyer behavior. For instance, eco-friendly brands may get promoted in California, while home tools and DIY gear might be highlighted in Texas

But personalization goes beyond geography. Using AI, Amazon builds individual sales feeds based on user’s browsing history, purchases, and engagement. Two buyers opening the Amazon app at the same time may see completely different offers.

Sellers’ advice: Separate ad campaigns by region, and plan inventory through tools like Amazon Warehousing & Distribution (AWD). Regional logistics increase listing visibility and reduce costs.5. Flexible Pricing & Price Perception Index (PPI)

Amazon’s new Dynamic Pricing Engine 3.0 now monitors prices across Amazon and competing platforms (Walmart, TikTok Shop, Temu, etc.). If a competitor lowers price, Amazon may adjust similar ASINs within hours.

The system uses a new metric — Price Perception Index (PPI) — to measure how reasonable your price appears to customers. A lower PPI (for example, because you didn’t apply a competitor’s discount) may reduce your product’s visibility.

Recommendation: Use automatic repricers and monitor PPI. It’s often better to lower price by 2–3% timely than to lose visibility entirely.6. Algorithmic Deal Visibility

After updates to the search algorithm A9, each type of promotion now follows its own success signals:

Lightning Deals — ranked by speed of engagement. If 50% of sales or clicks happen within the first hour, the deal receives extra promotion.

Coupons and Best Deals — prioritized based on “content richness”: presence of video, A+ content, and storytelling dramatically influences visibility. As a result, a well-designed listing often performs better than a product with a higher discount but weak content.

7. Rufus — Amazon’s AI Shopping Agent

Perhaps the biggest innovation of 2025 — the AI assistant Rufus. It understands search context, buyer intent, past behavior, and preferences. A shopper can now ask: “Which affordable massage gun suits athletes?” — and Rufus will return items with strong reviews, high ratings, and current promotions.

Rufus evaluates not just price, but also listing completeness: presence of video, A+ content, brand story, and reviews. Listings lacking these elements are far less likely to appear in Rufus’s recommendations.

Seller recommendations: Write descriptions in natural language, answer common questions, update A+ content; think of the listing as a mini-landing page optimized for AI understanding.8. Visual Content Is KING in 2026

In 2026, visual assets are not optional — they are critical. Amazon tracks whether your listing includes images, videos, storytelling blocks, and other rich media:

The first image drives click-through rate and influences inclusion in personalized feeds.

A+ content increases session time and improves ranking.

Video content boosts CTR by 25–30% during sales events.

9. AWD — Smart Logistics and Regional Strategy

The Amazon Warehousing & Distribution (AWD) program is becoming central to sale logistics. It lets sellers distribute stock across regions in advance — improving delivery speed and boosting visibility during sales.

During micro-sales or major events, listings located closer to the buyer are prioritized. For Private Label sellers, this is a strategic advantage: faster delivery increases ranking and impression volume.

Recommendation: Plan stock distribution through AWD at least 6 weeks before campaigns. This improves delivery speed and boosts visibility in personalized feeds.10. What Sellers Should Do in 2026

To adapt and succeed under the new model:

Analyze category trends. Use tools like Brand Analytics to identify growing demand.

Automate pricing. Monitor Price Perception Index and implement repricing.

Increase product value. Improve product quality and usability to stand out against competitors.

Invest in visual content. Add videos, infographics, and storytelling to your listing.

Optimize listings for AI — write in natural language, anticipate questions, and build full descriptions.

Distribute inventory regionally via AWD to ensure fast delivery and higher visibility.

Use a combination of Lightning Deals + DSP (ads) to retain audience and drive repeat sales.

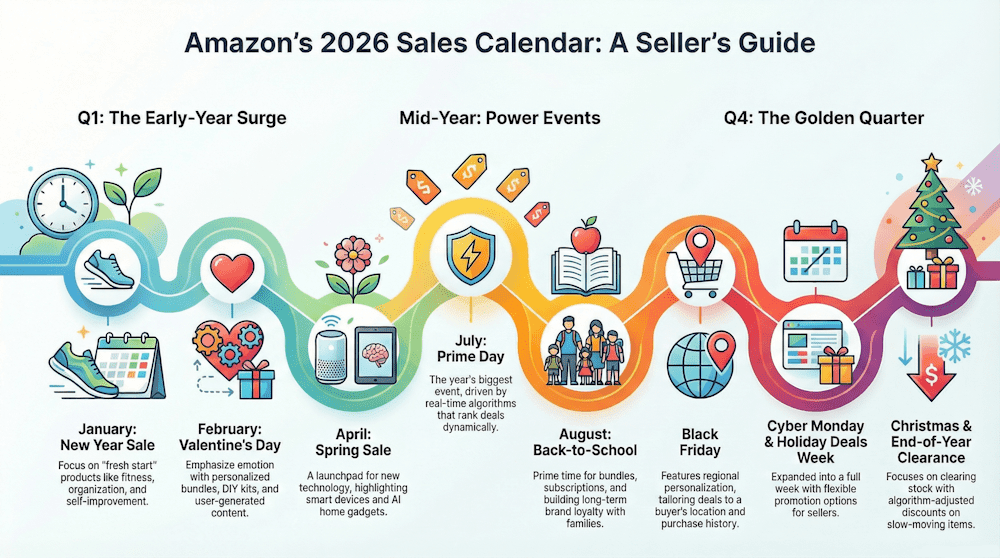

2026 Key Event Calendar

Amazon is shaping its marketing year as a continuous chain of purchase triggers — spreading traffic peaks and logistics pressure more evenly across seasons. Here are the key events shaping the next year

Amazon Sales 2026

The Early-Year Deal Surge (Q1 2026): A Fresh Start

1. New Year Sale (January)

Shoppers return motivated to “start the year clean.” Amazon pushes lifestyle-reset categories — fitness, self-improvement, home organization. Products under Renewed Plus and refreshed Private Label collections receive priority visibility.

2. Valentine’s Day (February)

This event is no longer only about gifts — it’s about emotions. Personalized bundles, DIY kits, and products with a narrative perform strongly and show higher CTR. Influencer collaborations and visuals built on real reviews and UGC are particularly effective.

3. Spring Sale (April)

Spring promotions become a launchpad for new tech. Amazon highlights smart devices and AI-enabled home gadgets. Sellers should update SEO and imagery, taking into account eco and smart living trends.Mid-Year Power Events (Q2–Q3 2026): The Mid-Year Momentum

4. Prime Day 2026 (July)

The biggest event of the year focuses on AWD-powered logistics and data. The Real-Time Deal Rank algorithm adjusts promotion visibility based on minute-by-minute sales dynamics. Sponsored TV and DSP video formats perform strongly with Prime audiences.

5. Back-to-School (August)

A key event for families and students. Educational tools, home essentials, bundles, and subscription products gain traction. For Private Label brands, it’s the perfect moment to retain customers and build long-term brand affinity.The Golden Quarter (Q4 2026): The Year’s Final Stretch

6. Black Friday

The biggest sales spike of the year — now enhanced with regional personalization. Buyers in different states see discount selections tailored to their purchase history. For sellers, local conversion data and regional ad costs become crucial inputs.

7. Cyber Monday & Holiday Deals Week

This event has expanded into a full week. Amazon gives sellers more flexibility: you can mix coupons, Lightning Deals, and promo structures. Brands that prepare their discount ladder and logistics in advance gain the widest reach and the most efficient campaigns.

8. Christmas & End-of-Year Clearance

The final push of the year — clearing out remaining stock. Algorithms automatically adjust discounts on slow-moving items. For sellers, this is a chance to free up storage and recover working capital before the new fiscal cycle begins.Conclusion

Amazon is becoming a dynamic, data-driven ecosystem. Sales events are no longer just marketing tactics — they’re algorithmic processes deeply tied to content quality, inventory logistics, pricing strategy, and AI-driven personalization. Discounts alone are no longer enough; you need to prove to Amazon that you understand your buyers and deliver value.

If you want to grow with the marketplace, you must master analytics, content, product value, and brand perception. Or work with trusted professionals who know how to navigate this new reality.Book a call now…

Book a call now…

Up to 45-min duration video-call

Topics we'll discuss:

| The next steps — there are two options

|