Amazon’s retail share drops below 41%, launches Bazaar to rival Temu, clashes with Perplexity over AI shopping — plus new SFP rules, QuickBooks lending, and A+ brand showcases

Amazon is redefining its business model. Retail now accounts for less than half of total revenue as service segments — ads, AWS, and seller tools — take the lead. The company also launched the low-cost Bazaar app for emerging markets, entered a legal fight with Perplexity AI, and introduced new SFP, lending, and brand display updates that reshape seller strategy

News #1. Retail Is No Longer Amazon’s Main Business

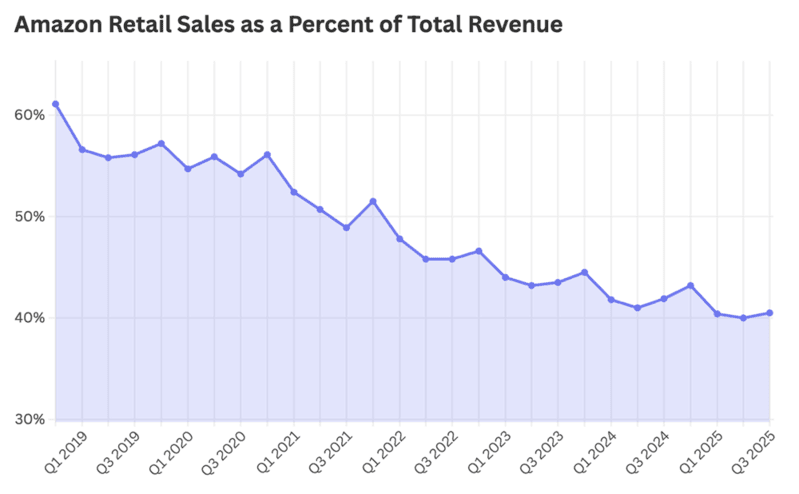

According to Amazon’s latest quarterly report, retail now accounts for only 40.5% of the company’s total revenue.

What Happened

In Q3 2025, Amazon earned $73 billion from online and offline product sales — while $107 billion came from service-based segments such as seller fees, advertising, subscriptions, and AWS cloud solutions. Seven years ago, retail represented 60% of Amazon’s business; four years ago, it dropped below 50% for the first time. This doesn’t mean marketplace sales are shrinking — rather, it shows how aggressively Amazon is expanding beyond retail.

Why It Matters

Amazon is rapidly evolving from an online retailer into a global infrastructure provider. Today, 60% of its revenue comes from services, not product sales.

Advertising generated $17.7 billion (+22% YoY)

Seller services brought in $42.5 billion

Third-party sellers now drive 62% of all sales, yet Amazon captures nearly half of their turnover through fees and value-added tools.

The company is also scaling Amazon Business (its B2B segment valued at over $50 billion annually) and expanding logistics solutions — Global Logistics, AWD, FBA, and Multi-Channel Fulfillment (MCF) — the latter growing 70% year over year, now serving orders from TikTok, Shopify, and SHEIN.

What It Means for Amazon Sellers

Amazon is no longer just a marketplace — it’s a full business platform. For sellers, this dual nature brings both opportunity and dependency: access to powerful infrastructure and vast traffic, but also growing reliance on Amazon’s paid services.

As we’ve pointed out before, Amazon is consolidating control over every part of its ecosystem. This means third-party service providers will gradually be pushed out, as Amazon continues to internalize more tools and solutions for sellers.

News #2. Amazon Launches Bazaar — a Budget Marketplace for Emerging Markets

Amazon has officially launched Amazon Bazaar, a new app expanding its “value shopping” concept — inspired by the success of Amazon Haul — into 14 new countries

What Happened

The platform features hundreds of thousands of products across fashion, home, and lifestyle categories, with most items priced under $10 and some starting from just $2. Bazaar is already available in Hong Kong, the Philippines, Taiwan, Peru, Argentina, Nigeria, and several other markets.

Why It Matters

Bazaar marks Amazon’s entry into the ultra-low-cost e-commerce segment, competing directly with Temu, SHEIN, and AliExpress. The app targets younger, price-sensitive shoppers with a gamified interface, flash deals, raffles, and a 50% discount on first orders. Shipping is free above a small threshold, with delivery times capped at two weeks. It uses existing Amazon accounts, supports free 15-day returns, and offers six languages, including English, Spanish, and Chinese. Analysts already call it “Amazon’s answer to Temu” — combining low prices, entertainment, and Amazon’s brand trust in one platform.

What It Means for Amazon Sellers

Bazaar opens a new channel for sellers focused on low-ticket, high-volume products, giving Amazon a foothold in fast-growing developing markets. For manufacturers and private label brands, it’s a unique testing ground for budget product lines, providing access to audiences previously unreachable through the core Amazon Marketplace.

News #3. Amazon vs. Perplexity: Clash Over AI Shopping and User Control

On November 4, 2025, Amazon sent a legal cease-and-desist notice to Perplexity AI, demanding that the company stop using Amazon Marketplace data in its Comet browser — where an integrated AI assistant lets users search and buy products without visiting Amazon’s website.

What Happened

Amazon claims this access violates its Terms of Service and “degrades the customer experience” by showing outdated listings and bypassing its internal recommendation and ad algorithms. Perplexity responded by accusing Amazon of “legal bullying and monopolistic behavior,” publishing an open letter titled “Bullying Is Not Innovation.” The company insists its AI acts on behalf of the user, without collecting personal data or violating privacy.

Why It Matters

This marks the first public conflict between Amazon and a third-party AI assistant developer in the emerging field of automated e-commerce. Amazon argues that only authorized partners can use its infrastructure to ensure service quality and protect ad revenue — a business segment that generates over $56 billion per year. Perplexity, however, positions itself as a pioneer of “agentic commerce” — a model where AI becomes a personal shopping agent, completing purchases through natural-language or voice commands. In essence, it’s a direct challenge to Amazon’s monopoly on user experience and behavioral data.

What It Means for Amazon Sellers

This conflict highlights how tightly Amazon guards its closed ecosystem: no external AI assistants — including ChatGPT, Claude, or Perplexity — can directly interact with the marketplace. That ensures Amazon retains full control over ads, traffic, and analytics, but also slows down the adoption of external innovation in e-commerce. If Perplexity wins regulatory support or forges strategic partnerships, it could usher in a new era where AI agents handle purchases independently — shifting power from platforms to users. For now, Amazon is signaling that it intends to maintain total control over customer data and the path to purchase.

Other Amazon News

New Rules for Seller Fulfilled Prime

Amazon has simplified participation in the Seller Fulfilled Prime (SFP) program.

Seller performance is now evaluated by product size category — Standard, Large, and Extra-Large.

This means a delay in one category no longer affects Prime status in others.The trial period has also changed: it now lasts four weeks, with weekly performance reviews.

Additionally, Shipping Settings Automation has been improved — customers now see precise delivery dates, and sellers using Buy Shipping or Veeqo receive protection for their On-Time Delivery Rate (OTDR).

These updates make SFP a more flexible alternative to FBA, while keeping logistics control in the seller’s hands.Amazon Lending Now Available via QuickBooks

Amazon has partnered with QuickBooks Capital to expand access to business financing.

Sellers can now apply for loans directly in Seller Central under Growth → Lending, with amounts ranging from $1,500 to $200,000 and repayment terms of 6, 12, or 24 months.The decision process is powered by QuickBooks data, allowing faster evaluations and more accurate credit assessments.

The new option is designed for small and medium-sized brands seeking working capital for inventory or marketing investments.A+ Shoppable Collections: A New Brand Showcase

Registered brands in Amazon Brand Registry can now create A+ Shoppable Collections — interactive, curated product sets displayed in the “From the Brand” section.

Sellers can group items under collections like Best Sellers, Seasonal Picks, or Highly Rated, and enhance them with images, videos, and clickable links leading directly to products.

This feature replaces the old Brand Story format, offering brands a visually engaging way to increase visibility and cross-sales — without additional ad spend.

Book a call now…

Book a call now…

Up to 45-min duration video-call

Topics we'll discuss:

| The next steps — there are two options

|