Amazon reshapes its seller ecosystem with paid SP-API access, Profit Analytics, AI-powered ads, and Rufus becoming a central shopping assistant

Amazon is introducing a series of updates that will redefine how sellers operate and advertise on the platform. Paid SP-API access changes how third-party tools work, Profit Analytics offers deep unit-level insights, AI-powered ads simplify targeting and optimization, and Rufus moves to a central role in search — all reshaping data management, profitability, and customer engagement

News #1. Amazon Begins Monetizing Its “Critical” Seller Tools

On November 3, Amazon introduced major changes to how developers access the Seller Partner API (SP-API) — the technical foundation behind Helium 10, Jungle Scout, Carbon6, and countless internal tools used by private-label brands.

What Happened

Amazon is switching the SP-API to a paid, per-request model and requiring stricter certification for all external tools. For the first time, developers will pay directly for API access.

Starting January 31, 2026, all tools must purchase a $1,400 annual subscription. Beginning April 30, Amazon introduces metered billing: the default Basic plan includes 2.5 million GET requests per month, after which tools pay $0.40 per 1,000 extra requests.

Higher tiers are aimed at enterprise-scale platforms:

Pro — $1,000/month for 25M requests

Plus — $10,000/month for 250M requests

Enterprise — custom

This officially ends 16 years of free access that began back in the MWS era in 2009.

What Changed

Amazon is implementing:

per-operation pricing for SP-API calls;

mandatory testing and certification for all apps;

new usage limits for unregistered and free tools;

tighter data controls to combat scraping and unapproved model training on seller data.

Many previously free features — including FBA inventory, orders, catalog, pricing, and ad data — now fall under paid access.

Why It Matters

The entire ecosystem of Amazon analytics tools will feel the impact. Operating costs for software companies will rise, forcing smaller apps to reconsider their position — some may simply not survive. Major platforms like Helium 10, Jungle Scout, or Carbon6 will stay, but subscription prices are expected to increase.

Marketplace Pulse analysts already call this shift a “seller infrastructure tax.”At the same time, Amazon continues tightening control over data access — part of a trend that started in 2024 with restricted reviews, enhanced VOC, and anti-scraping enforcement.

Expected Impact for Sellers

Software will become more expensive. Premium tools relying on SP-API are likely to increase pricing.

Small apps will disappear. Sellers will have to choose between major players or Amazon’s own tools.

Amazon deepens its closed analytics ecosystem. Internal solutions like Custom Analytics, Product Opportunity Explorer, Search Analytics, and VOC grow in importance.

Grey-area tools will vanish. API pricing and certification leave no room for unofficial solutions.

It also remains unclear whether all data will be accessible via the API. In particular, many sellers are still dissatisfied with Voice of Customer and would like to return to analytics provided by third-party developers.

News #2. Amazon Introduces Profit Analytics — a Deep-Dive Tool for Unit Economics

Amazon has rolled out Profit Analytics, a new advanced reporting tool that gives sellers unprecedented visibility into SKU-level profitability, price modeling, and 90-day financial forecasting.

What happened

This is Amazon’s most significant update to financial analytics in years. The new tool consolidates sales, returns, advertising, FBA fees, commissions, logistics, and product costs into a single dashboard.

What the tool can do

Profit Analytics captures over 34 fee types and more than 10 cost categories, including FBA fulfillment, inbound charges, returns, logistics, and advertising expenses — even external spend on Meta, TikTok, and Google.

Two modes are available:

Totals, for overall performance

Unit Economics, for margin analysis at the product level

The tool also allows sellers to:

review two years of historical data and project performance 90 days ahead,

model price changes and see their impact on profitability,

factor in external COGS and off-Amazon logistics,

drill into any metric with one click,

analyze catalogs of up to 500,000 SKUs without downloading reports.

Why it matters

For the first time, Amazon is giving sellers a complete view of true profitability inside Seller Central. For many, this will replace manual spreadsheets, BI dashboards, and third-party tools like Sellerboard or Shopkeeper. Most importantly, Amazon now offers built-in unit economics modeling — no exports required.

What this means for sellers

Profit Analytics is already live under Reports → Selling Economics and Fees.

Clear SKU-level margins, including hidden fees and indirect costs

Insight into how pricing, promotions, or shipping changes affect profit

Stronger native analytics, reducing the need for external financial tools

News #3. Amazon Ads unBoxed Introduces a New Level of AI-Powered Advertising

At the annual Amazon Ads unBoxed 2025 conference, the company unveiled updates that significantly reshape Amazon’s advertising ecosystem. The main focus this year is the deep integration of AI across the entire stack — especially within Amazon DSP.

What Happened

Advertisers can now set goals and a budget, and the system will automatically select audiences, optimize delivery, and adjust strategies in real time.

Experts are already calling this the biggest DSP upgrade in years, noting that Amazon’s ad stack is becoming far more powerful — and noticeably smarter.

What’s New in Amazon Advertising

1. AI Targeting in Amazon DSP

The most important update is a new mode where AI fully manages audience selection.

The system analyzes shopper behavior, browsing history, intent signals, and multimodal data to decide when and to whom ads should be shown.Early tests show major improvements: higher ROAS, lower CPC, and significantly broader reach without wasting budget. The new DSP model is closer to the concept of Performance Max — but with much deeper insight into Amazon’s proprietary data.

2. New AI Features in Sponsored Ads

Updates affect both Sponsored Products and Sponsored Brands:

Expanded auto-campaign capabilities

Better keyword suggestions

More accurate bid optimization models

According to expert insights, Amazon’s algorithms now work better with long-tail queries and take shopping context into account — something earlier auto-campaigns struggled with.

3. Upgrades to Creative Tools

Amazon also strengthened its AI-powered creative tools. Advertisers can now:

Generate images tailored to specific audiences

Automatically enhance banners and videos

Run A/B tests directly within DSP’s AI optimization layer

For many brands, this means faster campaign launches without constant designer involvement.

Why It Matters

Amazon is actively reshaping its advertising business. AI is becoming the core of the entire system — from targeting to creatives.

The result: advertising becomes simpler, more accessible, and more effective… but also less transparent. Advertisers gradually lose manual control and become more dependent on algorithmic decisions.What This Means for Amazon Sellers

For sellers, the trend is mixed:

The key takeaway: Amazon is making a decisive shift toward an AI-centric advertising platform. And it’s clear that in 2026 we’ll see even more automation, with manual settings slowly moving into the background.

On one hand, campaigns become easier to launch — even beginners can run DSP and achieve meaningful results.

On the other, competition in automated formats will intensify, since high-performance campaigns no longer require experience or large budgets.

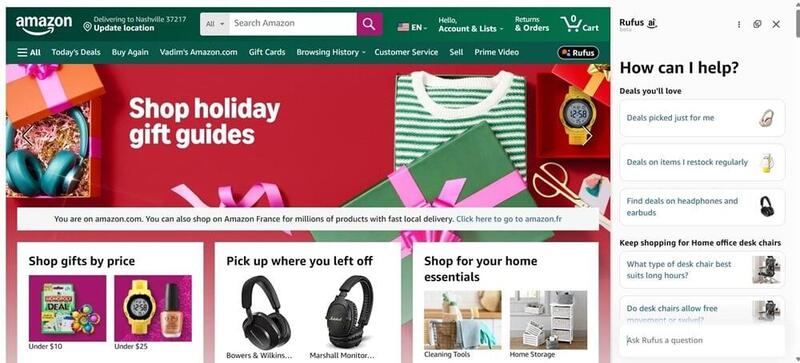

News #4. Rufus Gets a Prime Spot — Signaling a Shift in Amazon Search

Amazon quietly moved the Rufus icon to the top of the screen, making it far more prominent. While it may look like a small interface tweak, experts see it as a clear signal that Rufus is evolving from a helper widget into a central search and shopping assistant.

What’s Changing

Rufus is being positioned as a fully integrated AI guide for shoppers. Instead of just answering queries, it will assist throughout the entire shopping journey — from exploring products and comparing options to providing recommendations and asking clarifying questions.

Some of the early updates include:

AI-driven recommendation cards appearing directly in search results

Interactive dialogues that proactively guide shoppers

Integration with external content, like reviews, articles, and videos

Amazon is moving toward a system where the shopping experience is centered on the AI assistant, rather than static product pages.

Implications for Sellers

Search visibility will increasingly depend on the quality of product data, customer feedback, visual content, and external trust signals like influencer mentions — not just traditional SEO.

Brands should focus on:

Enhancing product content and visuals

Leveraging social proof and influencer partnerships

Ensuring all product details are complete and well-structured

The key takeaway: AI-driven search is becoming the new standard on Amazon, and classic SEO alone will no longer be enough to maintain visibility.

Why It Matters

According to Amazon CEO Andy Jassy, shoppers who engage with Rufus during their buying journey are 60% more likely to complete a purchase. This emphasizes how central AI will become in shaping both discovery and conversion.

Amazon is clearly signaling the start of a new era, where the AI assistant becomes the main gateway to shopping — and sellers need to adapt to remain competitive.

Book a call now…

Book a call now…

Up to 45-min duration video-call

Topics we'll discuss:

| The next steps — there are two options

|