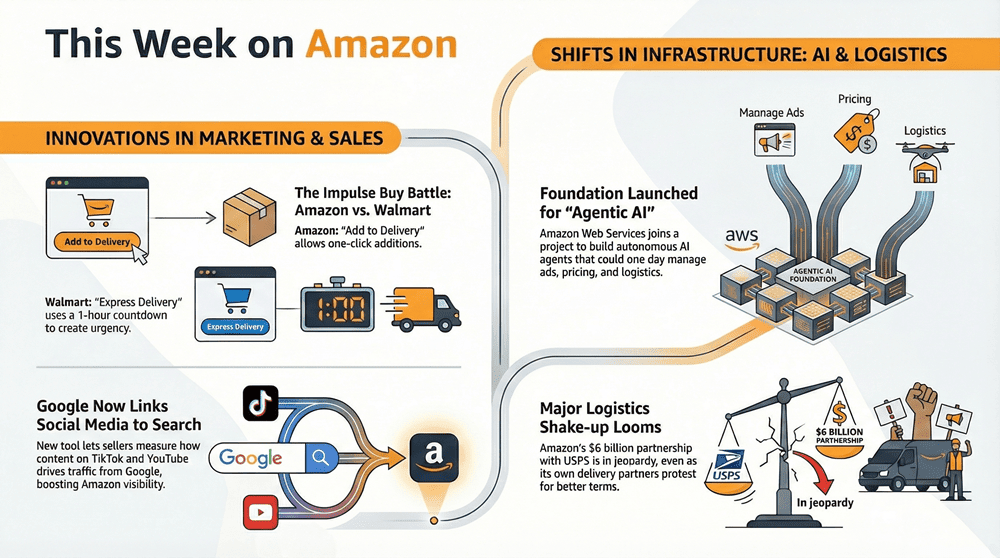

Amazon and Walmart push instant buying, Google links search with social, agentic AI goes open-source, and Amazon rethinks last-mile delivery

News #1. One-Click Buying and One-Hour Delivery — How Amazon and Walmart Are Speeding Up Holiday Shopping

What happened

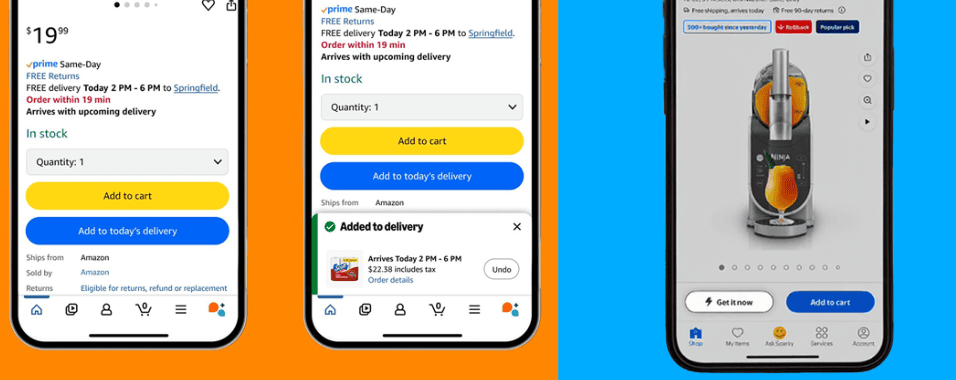

As previously announced, Amazon launched Add to Delivery, a feature that lets shoppers add items to an existing order with a single tap, bypassing the cart and standard checkout flow. Customers simply press the blue Add to Delivery button, and the product is instantly added to an upcoming Prime shipment — no new payment step, no extra confirmation. Beyond convenience, the softer blue button (compared to Amazon’s classic yellow-orange) subtly reduces the psychological friction of spending.

At the same time, Amazon extended its Prime delivery and FBA shipping cutoff to December 23, giving sellers two extra days to capture late-season demand.

Walmart responded with its own speed play. The retailer introduced Express Delivery, offering one-hour delivery available until 5:00 p.m. on Christmas Eve. It also launched Get It Now in the app — a one-click order feature paired with a live countdown timer showing exactly how long until delivery. Seeing “arrives in 42 minutes” creates a powerful sense of urgency that pushes impulse decisions.

Why it matters

Both companies are aggressively removing “moments of doubt” from the purchase funnel. Amazon lowers the barrier to impulse buying through frictionless convenience, while Walmart leans into urgency and time pressure. In effect, Amazon sells ease, while Walmart sells the feeling of winning back time.

Interface psychology plays a key role. Amazon’s Add to Delivery button feels lighter and less committal than “Buy Now,” reducing spending anxiety. Walmart does the opposite — amplifying urgency through visual countdowns that encourage fast action.Together, these updates reinforce a broader shift toward Amazon impulse buying, where convenience and timing eliminate hesitation and turn spontaneous intent into immediate action.

What it means for sellers

The line between decision and purchase is rapidly disappearing. For sellers, this is a double-edged sword: higher conversion rates may also lead to more impulse orders — and, inevitably, more “ordered by mistake” returns.

To stay in control, sellers should:

Closely monitor return reasons;

Watch for spikes in cancellations and repeat orders;

Refine content and images to reduce accidental clicks and mismatched expectations.

Convenience fuels sales — but without careful oversight, it can also drive refunds. As Amazon and Walmart accelerate the path to purchase, sellers must adapt just as quickly to protect margins during the holiday rush. This potential shift highlights Amazon’s broader last-mile strategy, aimed at full control over delivery speed, costs, and customer experience.

News #2. Google Blends Search and Social — How the New Tool Can Boost Amazon Brand

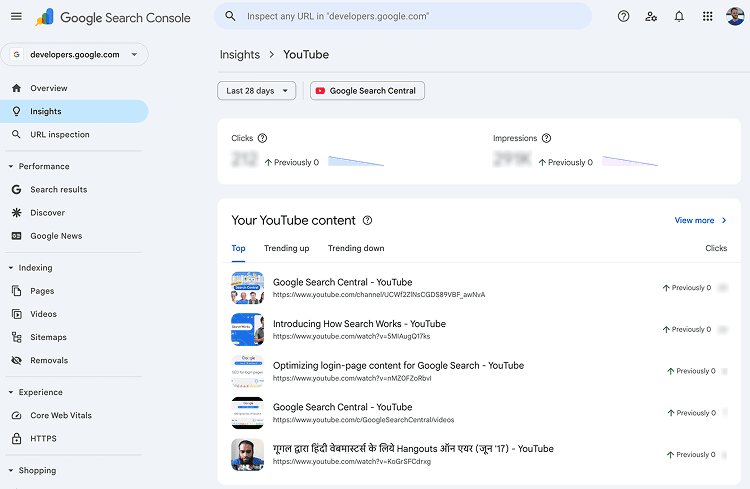

Google has launched an experimental feature called Social Channel Insights inside Google Search Console.

What happened

The update shows how a brand’s social media content — from YouTube, Instagram, TikTok, and Pinterest — influences visibility in Google Search. This marks Google’s first real step toward merging SEO and social media, and it opens new opportunities for Amazon sellers to manage product discovery beyond the marketplace.

With Social Channel Insights, brands can now see:

How many users move from Google Search to their social profiles;

Which posts and videos drive the most traffic;

What search queries lead users to the brand via social content;

Which countries those visits come from.

Why it matters

According to industry data, nearly 40% of younger shoppers (ages 12–28) search for products and inspiration on TikTok and Instagram, not Google. In the U.S., about two-thirds of consumers use social platforms to discover or compare products before buying.

Google is clearly trying to win this audience back by connecting social content with search results. Posts, videos, and reviews are becoming part of a unified visibility layer — directly affecting how users discover brands and products online.

What it means for Amazon sellers

External traffic plays a growing role in Amazon rankings. When a brand attracts visitors from Google and social platforms, Amazon’s algorithms often interpret this as a positive signal — helping improve search visibility on the marketplace itself.

YouTube and TikTok are becoming part of “product search.” Product demos, how-to videos, and reviews can now surface in Google Search alongside Amazon listings. Sellers creating video content can finally see which assets actually drive buyer intent.

Influencer and ad performance becomes measurable.Measuring the real impact of creator collaborations has always been difficult. Social Channel Insights helps identify which posts genuinely bring users closer to a purchase through search.

New promotion opportunities.When a post or video starts gaining traction, sellers can reinforce demand with Amazon Ads and coupons, turning external visibility into direct Amazon sales.

Takeaway

News #3. Block, Anthropic, and OpenAI Launch the Agentic AI Foundation — Amazon Joins the Initiative

Block, Anthropic, and OpenAI have announced the creation of a new nonprofit organization — the Agentic AI Foundation (AAIF). The foundation aims to advance agentic AI: systems capable of acting autonomously, making decisions, and interacting with other software without constant human input.

What happened

AAIF is hosted under the Linux Foundation and is designed as a neutral platform for developing and standardizing agent-based AI technologies. Participants include Amazon Web Services, Google, Microsoft, SAP, Salesforce, Shopify, Uber, and others.

The foundation brings together three major building blocks from its founders:

goose (Block) — a framework for building autonomous AI agents;

Model Context Protocol (MCP) (Anthropic) — an open protocol that allows AI systems to securely access context and external data;

AGENTS.md (OpenAI) — a documentation format that helps AI systems understand developer intent and tasks.

These projects will now evolve into a shared open standard, similar to how the W3C once established common rules for the modern web.

Why it matters

Agentic AI represents the next step beyond chatbots and generative models. Instead of merely responding to prompts, AI agents can plan actions, analyze data, and execute tasks independently — from sourcing suppliers to adjusting prices or managing advertising campaigns. Agentic systems mark a transition from automation to AI-driven commerce, where decisions, execution, and optimization increasingly happen without direct human input.

By creating an open ecosystem, AAIF reduces the risk of vendor lock-in and monopolization, while accelerating the development of interoperable AI solutions across platforms and industries.

What it means for Amazon and sellers

With AWS participating in AAIF, future agentic AI standards are likely to be compatible with Amazon’s cloud infrastructure. This lowers the barrier for integrating autonomous AI solutions into the broader Amazon ecosystem.

Over time, sellers and brands using AWS-based AI tools or Amazon Ads could deploy AI agents that automatically manage advertising, logistics, and analytics. In the longer term, this opens the door to semi-autonomous commerce workflows — from demand forecasting to dynamic pricing and assortment optimization.

Agentic AI is not just another feature — it’s emerging infrastructure that could underpin business automation across Amazon and e-commerce as a whole within the next few years. Open agentic AI standards could redefine how sellers automate operations — if platforms like Amazon truly support openness.

P.S. One open question remains: how committed is Amazon to truly open AI? The company has steadily built a more closed ecosystem — with Alexa, Rufus, proprietary seller AI tools, and restricted access to marketplace data for external models. These moves suggest a strategy focused more on control than open collaboration, making Amazon’s long-term role in open agentic AI worth watching closely.News #4. Amazon Rethinks USPS Partnership Amid Tensions With Its Own Delivery Network

Amazon’s long-standing partnership with the U.S. Postal Service (USPS) is under pressure. Negotiations between the two sides have reportedly stalled, raising the possibility that Amazon may scale back — or even exit — the relationship and further expand its in-house delivery network. At the same time, Amazon is facing growing discontent among its own delivery partners text box.

What happened

According to The Washington Post, USPS plans to launch an auction in 2026, forcing Amazon and other major clients to compete for access to postal capacity. Amazon had expected a renewed contract with fixed rates and guaranteed volumes, but after nearly a year of talks, it was informed that the terms would change.

One likely outcome is deeper investment in Amazon’s proprietary logistics — including Amazon Air and the Delivery Service Partner (DSP) program. For USPS, losing Amazon would be a serious blow: the company generates roughly $6 billion a year for USPS (about 7.5% of its revenue), while the postal service is already reporting $9 billion in losses for 2025.

Why it matters

A break with USPS would push Amazon closer to becoming a fully closed logistics ecosystem — controlling not just orders and warehouses, but the last mile as well. While this increases Amazon’s independence, it could also drive higher logistics costs, potentially passed on to sellers.This potential shift highlights Amazon’s broader last-mile strategy, aimed at full control over delivery speed, costs, and customer experience.

A new challenge: delivery partners push back

As talks with USPS stall, Amazon is also facing unrest inside its own delivery network. According to The Wall Street Journal, some owners of small DSP businesses have formed an informal group called DEFT (DSPs for Equitable and Fair Treatment). The group is pushing for higher compensation and a greater say in contract terms — an unusual move in a system tightly controlled by Amazon.

What it means for Amazon sellers

Short-term changes in logistics could affect delivery speed and costs, especially for U.S.-based FBA sellers.

Expanding Amazon’s internal delivery network may eventually improve fulfillment speed, but the transition period could be unstable.

Sellers should closely monitor logistics-related notifications, particularly those involving route changes or redistribution centers.

If Amazon ultimately distances itself from USPS, it would mark a turning point for the U.S. logistics landscape — and another major step toward Amazon’s full control over last-mile delivery. For sellers, that means watching logistics updates as closely as pricing or ad changes in the months ahead. Any disruption in last-mile logistics will ripple directly into seller margins, delivery promises, and customer satisfaction.

Book a call now…

Book a call now…

Up to 45-min duration video-call

Topics we'll discuss:

| The next steps — there are two options

|