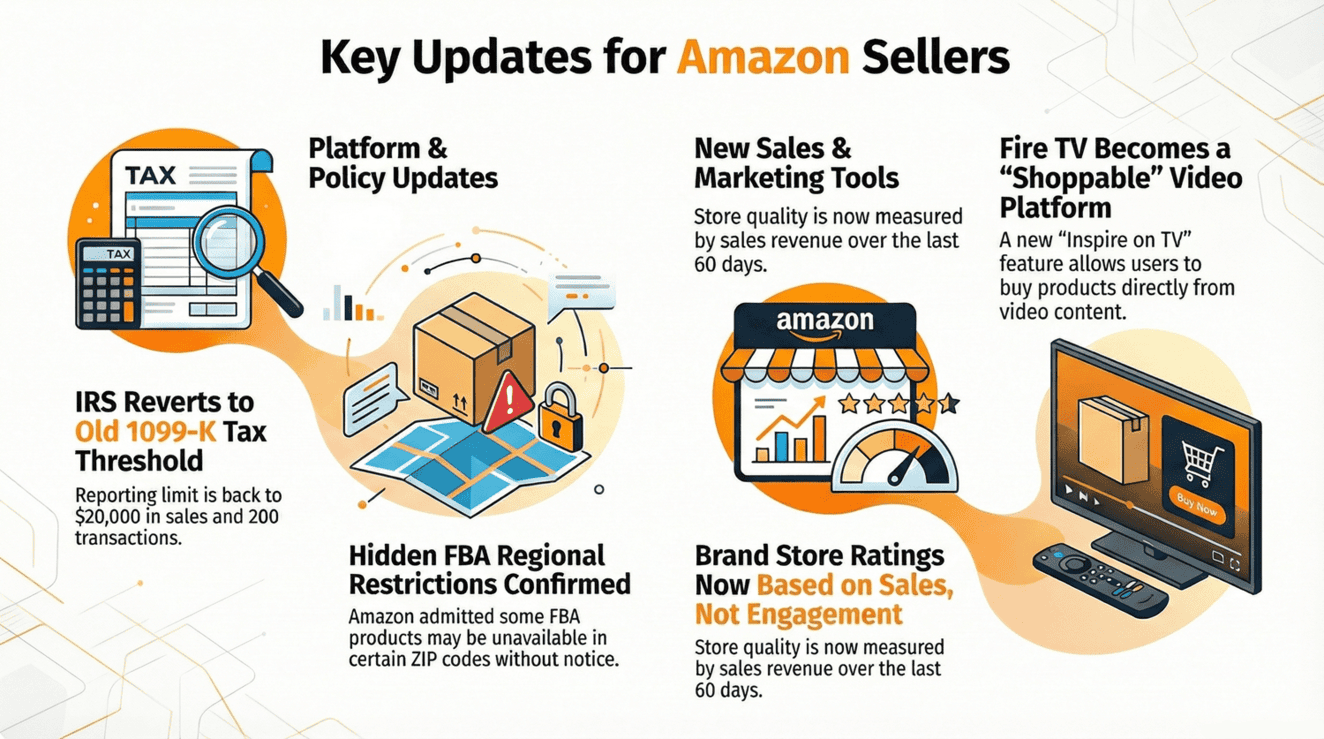

Amazon clarifies 1099-K rules for 2026, shifts Brand Store ratings to sales, turns Fire TV into a shopping feed, and admits ZIP-code FBA restrictions.

News #1. IRS Reverts to Old Rules — Amazon Explains How Sellers Should Prepare for the 2026 Tax Season

What happened?

As of December 18, Amazon updated the Account Health section and published official guidance on preparing tax documentation for the 2025 reporting year. The key takeaway:

Form 1099-K is required only if a seller exceeds $20,000 in gross revenue and 200 transactions during the year

Internal Revenue Service has formally abandoned the plan to lower the threshold to $600

Amazon will begin issuing 1099-K forms in January 2026, either electronically or by mail (seller’s choice). All forms will be sent no later than January 31 and will be available in Reports → Tax Document Library. For non-U.S. sellers, there is an additional requirement: Form W-8 must be updated by December 30, 2025. Failure to do so may result in a temporary suspension of selling privileges.

Why it matters

The decision reduces the tax reporting burden for small sellers — but only if account data is up to date. Amazon is legally required to report seller information to the IRS when thresholds are met. Even if you don’t meet the 1099-K criteria, completing the Tax Interview remains mandatory. Missing or outdated tax information can still lead to restricted account functionality. It’s also important to note that some U.S. states (including Massachusetts, Vermont, and Maryland) maintain lower reporting thresholds than the federal standard.

What it means for Amazon sellers

Review your tax profile in Seller Central → Tax Information → Tax Interview

Make sure your W-8 or W-9 forms are valid and accurate — incorrect TIN/EIN/SSN details can delay payouts

Non-U.S. sellers should complete W-8 updates before December 30

Keep a copy of your 1099-K — it will be required when filing your 2026 tax return

Takeaway

News #2. Amazon Updates Brand Store Rating Logic — Sales Now Matter More Than Engagement

Amazon has updated how Brand Store Quality Rating is calculated. Under the new model, store quality is now measured by sales performance, not customer engagement. Previously, Amazon evaluated Brand Stores based on metrics like time spent on the page — now, actual revenue is the core signal.

What happened

On December 12, Amazon Ads announced that Brand Store Quality Rating will reflect sales over the last 60 days. Sellers now see one of three ratings — High, Medium, or Low — and can benchmark their Brand Store against similar brands using two new metrics:

SALES_LAST_60_DAYS — total sales generated by the Brand Store

PEER_SALES_LAST_60_DAYS — average sales performance of comparable Brand Stores in the same category

The update is live across most Amazon marketplaces, including the U.S., Canada, Europe, Asia, Latin America, and the Middle East.

Why it matters

This shift mirrors a broader trend in digital marketing: moving away from engagement metrics toward measurable business outcomes. Amazon is aligning analytics across its advertising ecosystem and making Brand Store data more usable for AI-driven campaign optimization. Sales provide a far more reliable indicator of effectiveness than “time on page,” which doesn’t always correlate with purchase intent. For Amazon’s algorithms, revenue signals are clearer, cleaner, and easier to optimize around.

What it means for Amazon sellers

Brand Stores are now evaluated as a direct part of the sales funnel, not just a branding asset. Sellers should analyze which pages and products actually generate revenue and reduce friction between discovery and purchase. The new peer comparison metrics also make it easier to spot underperformance and understand where a Brand Store lags behind competitors in the same category.

Takeaway

Amazon is doubling down on performance-based measurement. Time spent browsing is no longer the goal — conversions are. This update reinforces a broader shift toward an ecosystem where content, ads, and brand assets are all judged by sales impact and efficiency, not vanity engagement metrics.News #3. Fire TV Becomes Instagram for Shopping — Amazon Merges Video and One-Click Purchases

Amazon has rolled out a redesigned Fire TV interface that blends streaming content with instant shopping. Users can now watch product reviews, cooking shows, and influencer streams — and add items to their cart without leaving the video.

What happened

Amazon has transformed Fire TV from a media device into a shoppertainment hub. In the new “Inspire on TV” tab, viewers see a feed of short, vertical videos — essentially an Instagram Reels–style experience optimized for TV screens. Each video is linked to Amazon products, and viewers can press Add to Cart directly from the remote. At the same time, Amazon launched a Creator Portal, where creators and brands can publish Fire TV content and track sales. Monetization works through a commission model similar to the Amazon Influencer Program. Industry observers note that this update feels like a revival of Amazon Posts, reimagined as video and scaled to the living room. Together, Inspire and Fire TV are becoming a new entry point for social shopping inside Amazon’s ecosystem.

Why it matters

Amazon is making a clear bet on CTV commerce (Connected TV) — a segment growing faster than traditional e-commerce. Embedding click-to-cart inside video collapses the path from intent to purchase to just seconds. Content, advertising, and checkout now live in a single flow, turning passive viewing into immediate action. In effect, Amazon is bringing the mechanics of mobile social platforms to TV screens — building its own social storefront, where the story around a product sells as much as the product itself.

What it means for Amazon sellers

A new sales channel: Product demos and reviews can now reach shoppers not only in Inspire feeds but directly on Fire TV.

Influencer marketing at scale: Partnerships with creators become a key way to surface products in the CTV storefront.

Clear attribution: Click-to-cart links views directly to purchases, making content ROI measurable.

Takeaway

News #4. Amazon Admits Some Products Are Unavailable in Certain U.S. ZIP Codes

Amazon has confirmed that some FBA products may be restricted at the ZIP-code level — without notifying sellers. The issue came to light after a seller noticed that their product, available via FBM, suddenly appeared as “Currently unavailable” in specific ZIP codes when sold through FBA. In Manage Inventory, everything looked normal: the listing was active, stock was available, and no violations were shown.

What happened

After weeks of back-and-forth with Seller Support, the seller received official confirmation: the ASIN had been temporarily included in an experimental regional delivery program. As a result, availability was automatically hidden in certain delivery zones — including New York, Miami, and Chicago. In a later response, Amazon acknowledged a shipping segments configuration error, which caused some FBA offers to appear only in specific states or counties. After escalation, the regional restrictions were removed and nationwide availability was restored.

Why it matters

This case exposed a little-known aspect of FBA: Amazon can limit product visibility by ZIP code without alerting the seller. For businesses, that means sudden sales drops with no obvious explanation — analytics look fine, inventory is healthy, and no warnings are issued.

How to check if your ASIN is affected

Open your product page and change the delivery ZIP code (top-left near the search bar).

If the product shows “Currently unavailable” in some locations but not others, a local restriction may be active.

Compare FBA vs. FBM offers: if FBM appears while FBA disappears, this is likely the issue.

What sellers can do

Sellers recommend opening a support case and requesting removal from the regional delivery program, referencing public discussions in Seller Forums. In some cases, the only workaround has been removing and resending FBA inventory under a new FNSKU.

Takeaway

Amazon has effectively confirmed that it is testing regional visibility algorithms for FBA listings, and configuration errors can artificially suppress sales in major cities. Until Amazon provides a transparent way to monitor such restrictions, sellers will need to rely on manual ZIP-code checks and close monitoring — especially if sales suddenly decline without a clear cause.Other Amazon Updates

Amazon Ends Commingling — New Labeling Rules from March 2026

Amazon will discontinue commingling starting March 31, 2026. Identical products from different sellers will no longer be pooled together for storage and fulfillment.

What changes:

Brand Registry brands can continue using manufacturer barcodes (UPC, ISBN, etc.) without Amazon stickers.

Resellers outside Brand Registry must use Amazon barcodes, even if manufacturer codes exist.

Products without manufacturer barcodes must use Amazon labeling for all sellers.

The update is intended to reduce mix-ups and improve supply-chain transparency.

Customer Service Metrics Updated

Amazon has enhanced Customer Service Insights in Feedback Manager.

Preventable Contact Rate is now Buyer Contact Rate, reflecting the share of buyer contacts related to quality, delivery, and fulfillment issues.

Average Contact Response Time now counts only processed contacts, making the metric more accurate.

These changes help sellers better diagnose service issues and protect account health.

New MCF Analytics Dashboard: More Data, More Flexibility

Amazon rolled out an updated Multi-Channel Fulfillment (MCF) Analytics dashboard. Sellers can now analyze up to a year of MCF data, including fees, delivery speed, SKU trends, and top products. New time filters, order-level reports, and visual charts make it easier to spot inefficiencies and optimize logistics—especially ahead of peak sales periods.

Book a call now…

Book a call now…

Up to 45-min duration video-call

Topics we'll discuss:

| The next steps — there are two options

|