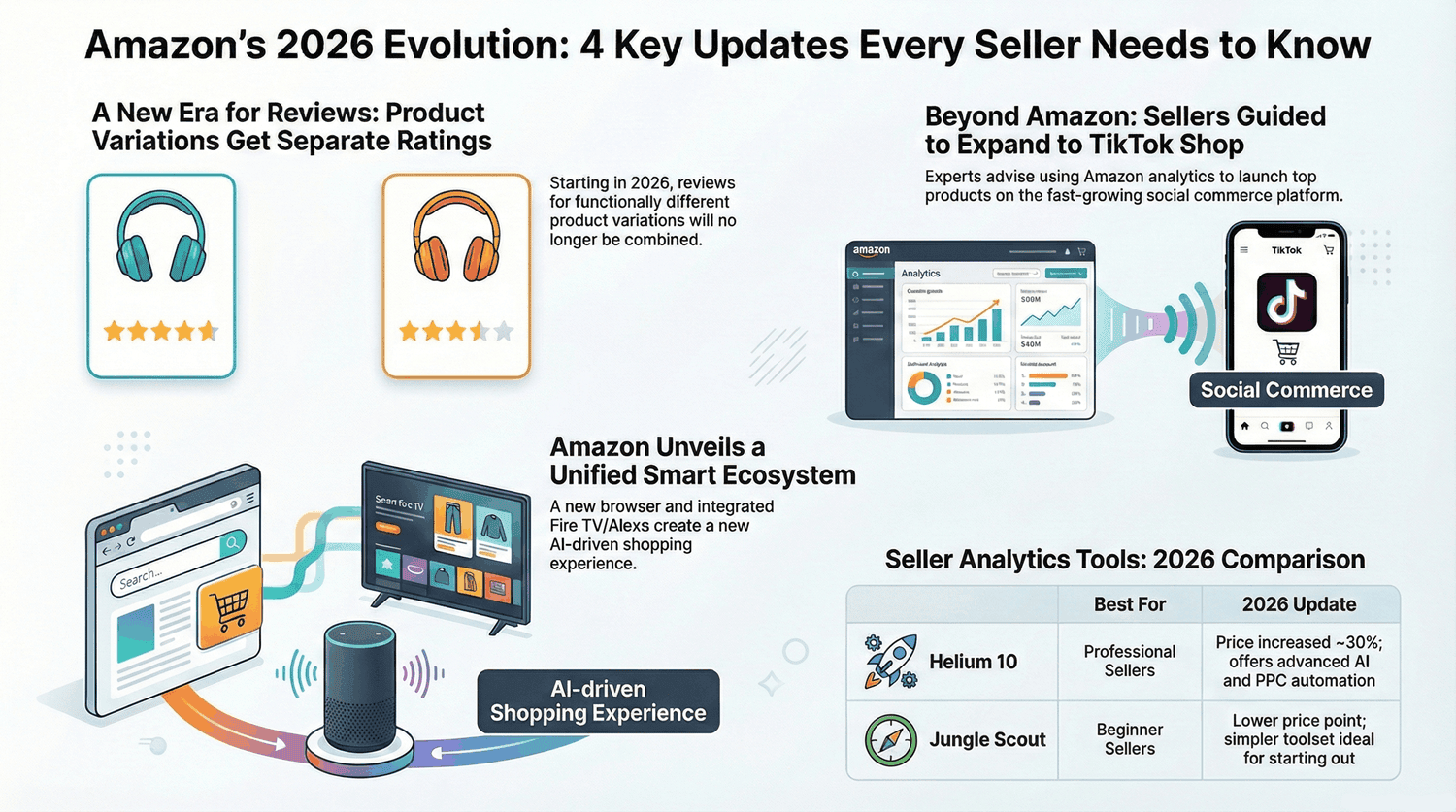

Amazon splits reviews by product variations, Helium 10 and Jungle Scout reshape pricing, TikTok Shop gains momentum, and Amazon unveils a unified ecosystem at CES 2026

News #1. Amazon Separates Reviews by Product Variations

What happened

Until now, different versions of a product — such as laptop models with varying specs or candles with different scents — could share the same review pool. This often misled shoppers, as ratings reflected feedback for entirely different variants.

Under the new rules, reviews will only be shared when differences are minor, such as color, size, or packaging volume. Variations that impact performance, composition, or user experience will each have their own review set.

Why it matters

As noted by PPC Land, Amazon is responding to long-standing criticism from both sellers and buyers frustrated by inflated or misleading ratings. The change is especially significant for electronics, beauty, and home appliances, where differences in power, formula, or model version directly affect customer satisfaction.

What it means for sellers

Once the update is live, many listings may see lower visible ratings, as each variation will retain only reviews that actually apply to it. Sellers should audit their variation structures and ensure that products with materially different characteristics are not improperly grouped.

In the long run, analysts expect the change to increase buyer trust and promote fairer competition within categories.

Takeaway

Amazon is effectively performing a review reset — moving to a system where every product variation must earn its own rating. While this will hurt sellers who relied on shared reviews to boost performance, it strengthens transparency and rewards brands that compete on genuine product quality.News #2. Helium 10 vs. Jungle Scout — Which Tool Makes More Sense in 2026?

Helium 10 has published a side-by-side comparison of the two leading Amazon analytics platforms — Helium 10 itself and Jungle Scout. The comparison follows a recent price increase from Helium 10 and is meant to help sellers reassess value versus functionality after both companies revised their plans.

What happened

As of January 5, 2026, Helium 10 raised subscription prices by roughly 30%, citing higher costs tied to AI infrastructure and the rollout of new tools. Jungle Scout, on the other hand, kept pricing unchanged but reduced features in its entry-level plan.

Why it matters

The comparison highlights a widening gap in positioning. Helium 10 remains the more expensive option, but it delivers a broader, more advanced toolkit — including PPC automation, keyword and rank tracking, competitor analysis, and the Profits module for margin and cash-flow insights.

Jungle Scout continues to focus on simplicity and accessibility, positioning itself as a streamlined solution for sellers who don’t need deep automation or advanced analytics.

What it means for sellers

The conclusion is straightforward:

Experienced and scaling sellers are likely to benefit more from Helium 10. Despite the higher price, it offers richer data, tighter integrations, and more automation across research, advertising, and operations.

New or early-stage sellers may find Jungle Scout a better fit — it’s more affordable, easier to learn, and sufficient for validating products and getting started.

News #3. Helium 10 Releases a Guide on Expanding from Amazon to TikTok Shop

Helium 10 has published a practical guide for sellers looking to expand beyond Amazon and launch sales on TikTok Shop. The release is notable: it’s the first time a leading Amazon analytics platform has laid out a structured strategy for entering social commerce — a channel widely expected to become one of the most important growth drivers in e-commerce by 2026.

What happened

The guide explains how sellers can leverage Amazon analytics and existing content to launch on TikTok Shop without sacrificing organic traffic or revenue on Amazon. Helium 10 experts recommend starting with top-performing SKUs that already have stable reviews, adapting video content to TikTok’s recommendation algorithms, and using Market Tracker to monitor demand shifts between platforms.

Why it matters

Amazon remains the core sales channel for most brands, but TikTok’s traffic is growing faster. According to the guide’s authors, conversion rates in TikTok Shop are already comparable to Amazon in categories like beauty, fashion, and gadgets. Sellers who ignore this shift risk losing audiences that are increasingly accustomed to buying directly from short-form video feeds.

What it means for sellers

TikTok Shop is not positioned as a replacement for Amazon — at least not yet. Instead, it works as a complementary channel. Helium 10 advises sellers to:

Use shared SKUs across platforms;

Synchronize inventory carefully;

Build a content funnel that connects TikTok discovery with Amazon fulfillment and trust.

Takeaway

Trends in online retail suggest that by 2026, video content and e-commerce will fully merge into a single flow of discovery, recommendations, and purchases. Helium 10’s guide signals that the shift is no longer theoretical — it’s operational, and sellers who adapt early will be better positioned for the next phase of commerce.News #4. Amazon Unveils a Unified Ecosystem at CES 2026

Amazon made a series of high-profile announcements at CES 2026 in Las Vegas, confirming its strategy to build a fully integrated smart-device ecosystem. CES (Consumer Electronics Show) remains the world’s leading tech showcase, where innovations set the tone for consumer electronics each year.

What happened

Amazon introduced updated versions of Fire TV, Ring, Alexa+, and a new web browser, Alexa.com — all unified into a single environment.

Fire TV now functions as a home control hub, while Ring and Echo devices are deeply embedded into the Alexa+ interface. The new Alexa.com browser becomes the central entry point to Amazon’s “smart” ecosystem, allowing users to search for products, manage devices, watch content, and complete purchases — all without leaving the interface.

Why it matters

Analysts describe this move as the creation of a “closed digital loop.” Search, content, hardware, and commerce are now connected through one AI-driven platform. Alexa+ is evolving into a proactive personal assistant — not just responding to commands, but anticipating user needs, from activating home security to recommending products.

What it means for sellers

For brands and Amazon sellers, this ecosystem opens up a new storefront layer. Voice- and screen-based recommendations are now embedded directly into Fire TV and the Alexa.com browser. Products optimized for voice search and AI-driven discovery are likely to gain priority placement within this environment.

Takeaway

Amazon is steadily transforming Alexa from a voice assistant into a full-scale digital platform, where the home, the screen, and shopping coexist in a single, tightly integrated space. For sellers, visibility in this ecosystem will increasingly depend on how well products are adapted to AI and voice-first discovery.Book a call now…

Book a call now…

Up to 45-min duration video-call

Topics we'll discuss:

| The next steps — there are two options

|