EU ends the €150 duty-free threshold, Amazon proves it’s the cheapest U.S. retailer, Rufus learns to auto-order, and new lithium-ion rules tighten FBA compliance

This week brings major shifts for global commerce: the EU removes its duty-free import limit, forcing Temu, Shein, and Amazon to rebuild logistics. Profitero names Amazon the cheapest U.S. online retailer for the ninth year. Rufus gains powerful new AI shopping abilities, and Amazon aligns lithium-ion battery policies with ICAO rules — adding new compliance steps for sellers

News #1. EU Ends Duty-Free Import Threshold: Amazon and Temu Reshape Global Logistics

The European Union has officially confirmed its plan to abolish the €150 duty-free threshold for imported parcels — following a similar move by the United States earlier this year. This marks the beginning of one of the biggest shifts in global e-commerce logistics in recent years.

What Happened

Until now, Chinese marketplaces such as Temu and Shein used a regulatory loophole that allowed them to ship low-value parcels directly from China without paying import duties if the declared value stayed below €150. Starting in 2026, the EU will introduce a transition phase, and by 2028, the threshold will be completely removed, meaning customs duties will apply from the very first euro.

How Chinese Marketplaces Are Reacting

Temu is responding to the new customs rules by rapidly building local warehouses and partnering with regional suppliers. By the end of 2025, the company aims to fulfill 50% of orders locally in the UK and up to 80% across the EU. For comparison, in mid-2024, only 20% of U.S. orders came from domestic hubs.

Temu has also launched supplier support programs in several countries. Shein is rolling out a similar QuickShip initiative, while TikTok Shop is expanding its Fulfilled by TikTok service to speed up deliveries.

How Amazon Is Responding

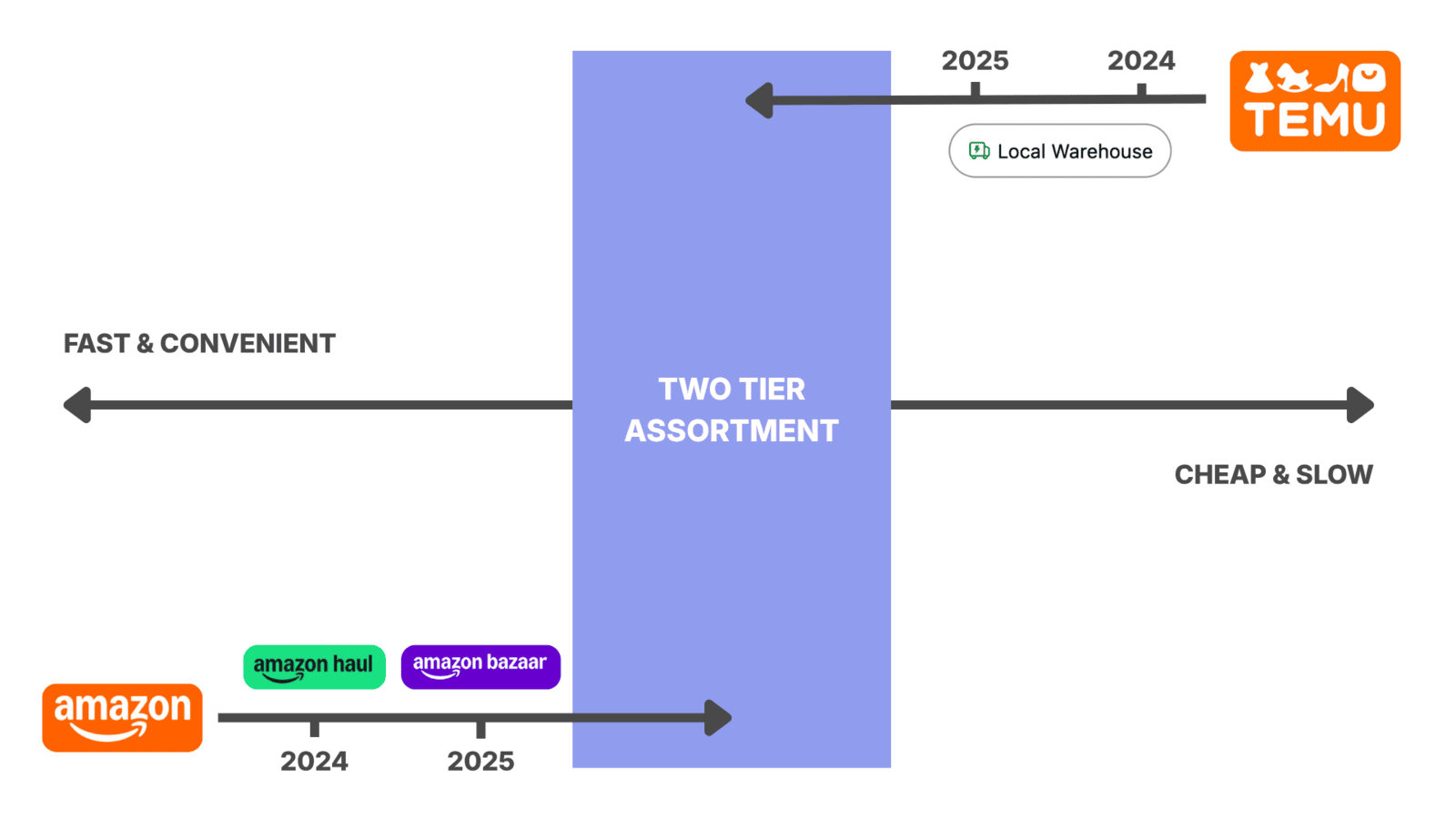

Amazon, meanwhile, is taking the opposite strategic direction. The company recently launched Amazon Bazaar, a low-cost shopping app available in 14 countries — from Peru to the Philippines — offering affordable items (under $20) with two-week delivery from China.

It’s a direct response to Temu’s success, allowing Amazon to build its own “low-cost” channel while maintaining Prime and FBA for fast, premium deliveries.

This signals a two-tier model emerging within Amazon’s ecosystem:

High-priced products with ultra-fast shipping (via Prime/FBA)

Low-cost items with slower, economy delivery (via Bazaar)

What It Means for Amazon Sellers

For Private Label sellers operating in the budget segment, it’s crucial to watch the evolution of Bazaar and Haul. These new markets don’t just offer scaling opportunities, but also let brands create locally tailored product lines for specific regions.

For mid-range and premium sellers, the priority is to optimize local inventory and shorten delivery times — since fast shipping directly boosts search visibility and conversion rates.

The removal of the duty-free threshold turns logistics into the next battleground for global marketplaces.

Neither Amazon nor Chinese platforms plan to back down — instead, they are borrowing each other’s strategies, intensifying the competition for global dominance.

News #2. Profitero: Amazon Is the Cheapest Online Retailer in the U.S. for the 9th Year

A new Profitero study confirms that Amazon remains the lowest-priced online retailer in the United States for the ninth year in a row.

What Happened

Across the market, Amazon’s prices are on average 14% lower than those of the 23 largest competitors.

Profitero analyzed 10,000+ products across 16 categories — from appliances and beauty to toys. Amazon ranked #1 in every category, with the strongest edge during the holiday season: in key gifting categories (electronics, toys, sports), prices were 5% lower than the nearest competitor.

Amazon also dominates in everyday essentials — groceries, household items, pet supplies — and in fashion, where the gap grows to 16% below other online retailers.

Why It Matters

As competition with Walmart, Target, and specialty retailers intensifies, Amazon is leaning heavily on price leadership to reinforce customer trust. The company promises “everyday low prices” and continuously monitors competitor listings — including other marketplaces and even sellers’ own DTC storefronts — to adjust pricing automatically.

Doug Herrington, CEO of Amazon Stores, highlighted that Amazon “does the hard work for customers,” constantly checking market prices to ensure the best offers across both retail and third-party listings.

What It Means for Amazon Sellers

For Private Label brands, this report is a reminder:

Amazon isn’t just competing on price — it’s making “being cheap” part of the customer experience.

Price competition is accelerating — Amazon increasingly favors the lowest-priced offers in each category.

Losing price parity reduces visibility; higher-priced items are disadvantaged in search and ranking.

Sellers need a value advantage, not just a price advantage — stronger packaging, differentiation, localized appeal, and quality signals help avoid a race to the bottom.

For sellers, this means price strategy must go hand-in-hand with fast delivery and strong product value.

News #3. Amazon Makes Rufus Smarter: AI Now Tracks Prices and Places Orders Automatically

What Happened

As of November 18, Rufus can now remember user behavior, track prices, place automated orders, and even buy from third-party sellers on the customer’s behalf. Since launch, Rufus has received 50+ technical updates. The assistant can now:

remember personal context (e.g., “two sporty kids and a dog”),

track price history over 30- and 90-day periods,

place automated reorders based on triggers (“repeat last year’s Thanksgiving order”),

read handwritten shopping lists and add items to the cart via photo.

Amazon reports that over 250 million customers already use Rufus, and purchase frequency is 60% higher when Rufus is involved.

Why It Matters

Amazon is betting heavily on agentic AI systems — assistants that can actively manage the shopping process, from price monitoring to checkout. This move counters rising competition from external AI-shopping agents like Perplexity and Google Gemini, which Amazon continues to block from interacting with the marketplace.

The new Rufus relies on Claude Sonnet, Amazon Nova, and Amazon’s own proprietary shopper data, allowing the company to retain full control over user experience and advertising revenue (which reached $17.7B in Q3 2025).

What It Means for Amazon Sellers

For Private Label sellers, Rufus creates both new opportunities and new risks:

Rufus is reshaping the future of Amazon: a marketplace where AI decides what shoppers see and buy. Sellers must now optimize for AI comprehension, context, and relevance, not just classic SEO.

Personalization becomes everything. If Rufus understands your customer’s intent, your chances of being recommended skyrocket.

Pricing, ratings, and reviews matter more than ever. Rufus tracks price trends and customer sentiment; products that fail to meet its “smart suggestions” criteria will lose visibility.

Listings must match natural, human queries. Rufus searches for phrases like “vacuum cleaner for an apartment with a dog”, not model numbers or keyword-stuffed titles.

AI-optimized content becomes critical. Amazon is turning into an ecosystem where purchases happen without scrolling product pages — meaning your product must be interpretable by AI, not just by humans.

News #4. Amazon Tightens Rules for Lithium-Ion Battery Products

Starting January 1, 2026, Amazon will enforce new safety requirements for all air-shipped products containing lithium-ion batteries.

What Happened

Sellers must confirm compliance with ICAO (International Civil Aviation Organization) standards by December 31, 2025. If not, affected items will be restricted to ground transportation only. Amazon updated its battery safety policy to align with ICAO regulations. Any product that contains — or is shipped with — a battery rated above 2.7 Wh must now verify that its state of charge does not exceed 30% prior to air transport.

These details must be added directly in the product listing or during SKU updates within Fulfillment by Amazon (FBA). If a seller fails to provide the required information on time, Amazon will automatically switch the ASIN to ground-only shipping until compliance is verified.

Why It Matters

Lithium-ion batteries are classified as high-risk cargo for air transportation. Following several incidents, ICAO strengthened international safety standards — and Amazon is now fully aligning its policies with these global rules.

For sellers, non-compliance may lead to:

delays in inbound shipments,

increased logistics costs,

temporary loss of FBA air delivery.

What It Means for Amazon Sellers

Before December 31, 2025, sellers must:

For Private Label sellers, this is especially critical: if products are manufactured to order, factories must be informed in advance. Any non-compliance in technical specs can block the entire FBA supply chain.

complete the updated Battery Compliance questionnaire in Seller Central,

review all products containing lithium-ion components — from electronics and toys to power-tool batteries,

prepare documentation verifying battery type and ≤30% state of charge.

Book a call now…

Book a call now…

Up to 45-min duration video-call

Topics we'll discuss:

| The next steps — there are two options

|