New Amazon seller sign-ups hit a decade low, Amazon launches AI assistant Amelia, Helium 10 compares true platform costs, and supplement sellers face a March deadline

News #1. New Amazon Seller Registrations Hit a Decade Low

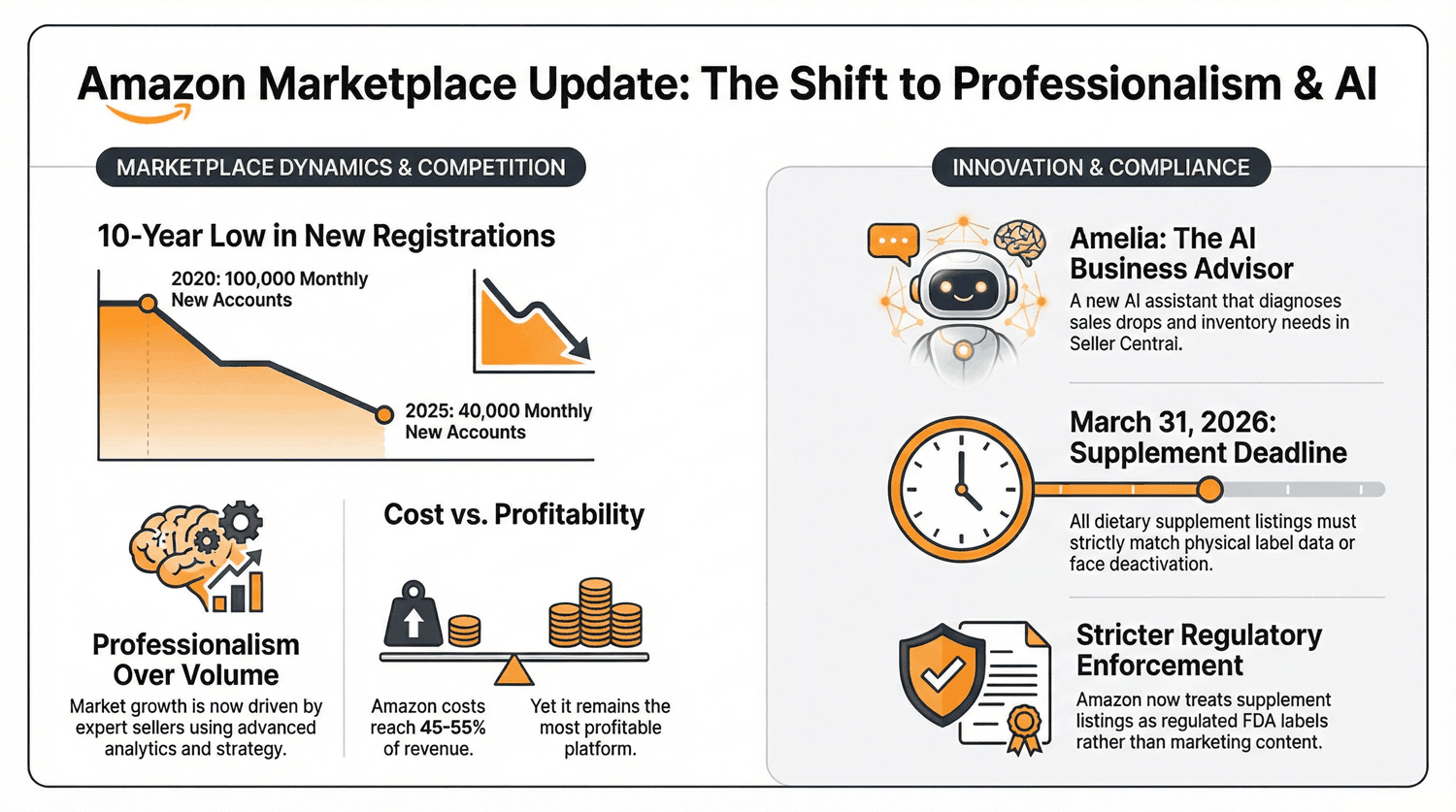

According to Marketplace Pulse, 2025 became the weakest year in the past decade for new Amazon seller registrations. For the first time since 2013, the total number of newly created seller accounts fell below one million.

For context: during the pandemic peak in 2020, Amazon saw over 100,000 new stores launched every month. In 2025, that figure dropped to around 40,000 per month on average.Why it happened

Analysts point to a combination of factors behind the slowdown:

Ongoing uncertainty around U.S. trade and customs policy;

Stricter KYC requirements across marketplaces;

Rising advertising costs;

Intensifying competition in most product categories.

At the same time, the share of professional and brand-led accounts continues to grow. Experienced sellers have adapted to the new environment — and many are still increasing revenue despite higher barriers to entry.

What it means for the market

Amazon remains the world’s largest e-commerce marketplace, but growth is now driven by seller maturity rather than volume. Entering the platform without preparation is becoming harder: success increasingly requires market knowledge, data-driven analytics, and a clear launch strategy.

Meanwhile, established sellers are strengthening their positions and capturing more value. Amazon is reinforcing this shift by rolling out advanced tools for niche discovery, demand analysis, and product launches.

Takeaway

Amazon is evolving into a more professional and predictable marketplace. While casual entry is no longer easy, this very shift makes the platform more attractive for serious, long-term businesses that are ready to compete with strategy — not luck.News #2. Amazon Launches Amelia — an AI Assistant for Sellers

Amazon has introduced Amelia, a new AI-powered assistant built directly into Seller Central, according to reports from Sellerapp. The tool analyzes sales, inventory, and advertising data — and explains what’s happening in your business right now.

What happened

Amelia is powered by Amazon Bedrock and acts like an in-account business consultant. Instead of digging through multiple reports, sellers can ask plain-English questions such as “Why did sales drop for this SKU?” or “Will my inventory last through the holiday season?” Amelia analyzes the data and returns a clear answer with actionable recommendations.

The assistant is currently available in beta to a limited group of U.S. sellers, with broader access expected soon.

Why it matters

Most sellers don’t struggle with a lack of data — they struggle with interpretation. Amelia connects metrics to real-world causes. For example, it can show that a sales drop is driven by suppressed search visibility, not seasonality. This saves hours of manual analysis and allows sellers to react before revenue declines.

What it means for Amazon sellers

New sellers get a faster learning curve, with guidance embedded directly in Seller Central.

Mid-sized sellers can offload routine diagnostics to AI, freeing up time for execution.

Large brands may want to wait for deeper automation: for now, Amelia provides insights, but actions still need to be carried out manually.

News #3. Helium 10 Compares the True Cost of Selling on Amazon, TikTok Shop, and Walmart

Helium 10 has released a new study breaking down the real cost of selling across three major platforms — Amazon, TikTok Shop, and Walmart. The research comes as more sellers explore alternatives to Amazon amid rising fees and advertising expenses.

What the study found

According to Helium 10, Amazon remains the most resource-intensive platform to launch and scale on. On average, 45–55% of revenue is absorbed by referral fees, FBA logistics, and advertising.

TikTok Shop offers a lower platform commission — around 20% — but sellers face additional costs tied to content production and influencer marketing.

Walmart sits between the two: lower marketplace fees are offset by stricter requirements for logistics, compliance, and listing quality.

Why it matters

The key takeaway is counterintuitive: higher costs don’t make Amazon less profitable for experienced sellers. Despite heavier fees, Amazon still delivers the strongest monetization for brands that understand the system. TikTok Shop and Walmart provide growth opportunities, but success there depends on different skill sets — especially external marketing and audience adaptation.

What it means for sellers

Platform choice is no longer about fees alone — it’s about strategy:

Amazon is best suited for scaling and long-term profitability;

TikTok Shop excels at rapid traffic generation and trend-driven sales;

Walmart works well for stable, niche-focused businesses.

News #4. Amazon Issues Ultimatum to Supplement Sellers — Inflated Ingredient Claims Must Be Fixed by March 31

What happened

Amazon’s Regulatory Intelligence team sent notices to supplement sellers requiring that all ingredient information on product pages exactly match the official label. A common practice is now explicitly prohibited: listing the weight of the raw material instead of the actual extract amount contained in the product.

For example, if a supplement includes 500 mg of an extract, sellers may no longer claim “10,000 mg” based on the starting plant material. All weights must be stated with the correct ingredient name and per-serving amount, exactly as shown on the label.

Why it matters

Experts view this as a clear shift in enforcement. Amazon is no longer treating supplement listings as marketing copy — it is treating them as regulated labels, applying standards aligned with FDA requirements.

Most upcoming deactivations are expected not because products are unsafe, but because listing text is outdated, exaggerated, or was never verified against the actual label.

What it means for Amazon sellers

Time is limited. Sellers must:

Audit all supplement listings;

Cross-check every claim against the Supplement Facts Panel;

Update descriptions and titles;

Upload clear, legible label images.

Listings using headlines like “10,000 mg for maximum effect” will require a full rewrite. Sellers managing large supplement catalogs should prepare for significant operational workload ahead of the deadline.

Takeaway

Amazon is tightening regulatory enforcement in the supplements category. Sellers who fail to align listings with label data risk mass deactivations — not over product quality, but over compliance accuracy.Book a call now…

Book a call now…

Up to 45-min duration video-call

Topics we'll discuss:

| The next steps — there are two options

|