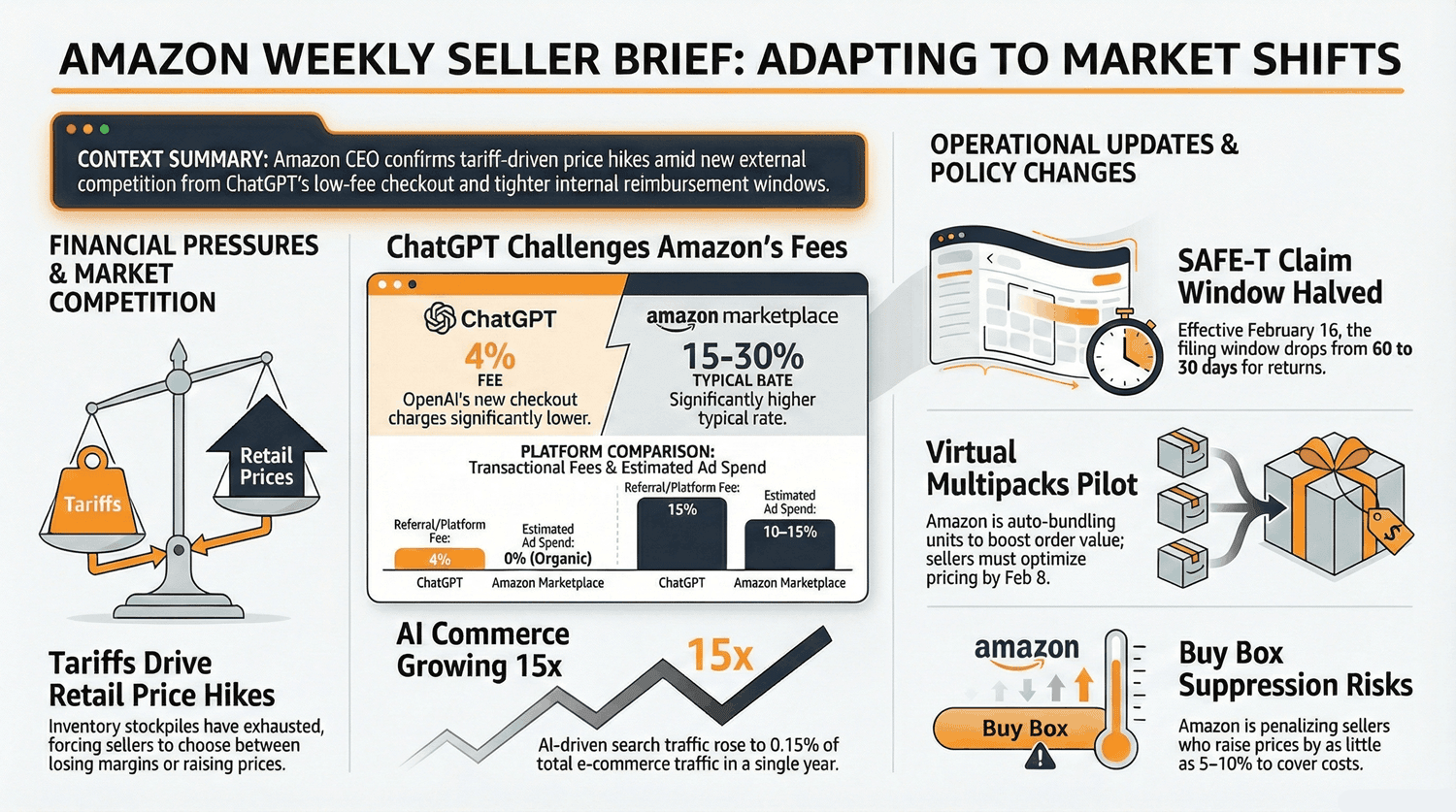

Amazon admits tariffs are raising prices, ChatGPT launches low-fee checkout, SAFE-T claim windows shrink, and FBA virtual multipacks go live

News #1. Amazon CEO Admits Trump Tariffs Are Driving Prices Higher on the Platform

What happened

In an interview in Davos, Jassy explained that Amazon and its sellers stockpiled inventory in spring 2025 to avoid price increases linked to Trump-era tariffs. Those inventories ran out by the fall, and consumers are now seeing higher prices.

Seller responses vary: some pass the added costs directly to buyers, others absorb them to protect demand, while many choose a middle ground. Amazon says customers are still spending — but shopping behavior has changed. Buyers are more price-conscious, actively looking for deals, and delaying purchases of higher-priced non-essential items.

This contradicts Jassy’s statements from July, when he called reports about tariff-driven price hikes exaggerated and argued that Amazon’s diverse seller base would keep prices low. He now acknowledges that options for price containment have largely been exhausted.

Why it matters

Jassy articulated what most sellers already know: retail operates on single-digit margins, and a 10% cost increase cannot simply be absorbed. Research shows that U.S. consumers ultimately bear about 96% of the tariff burden, which has generated roughly $200 billion in government revenue.

Sellers face a difficult reality. Industry reports indicate that in 2025 Amazon suppressed Buy Box eligibility for sellers who raised prices by as little as 5–10%. One seller behind the Wall Decals brand said his listing was penalized after a $2 price increase, even though his costs rose 25% due to tariffs on Chinese imports.

What it means for Amazon sellers

Survival increasingly means choosing the least damaging option. Raising prices risks losing traffic; absorbing costs destroys margins. Compromise strategies only work while reserves last. Since no seller has infinite resources, price increases eventually become unavoidable.

News #2. ChatGPT Launches Checkout with a 4% Fee — A New Competitive Threat to Amazon

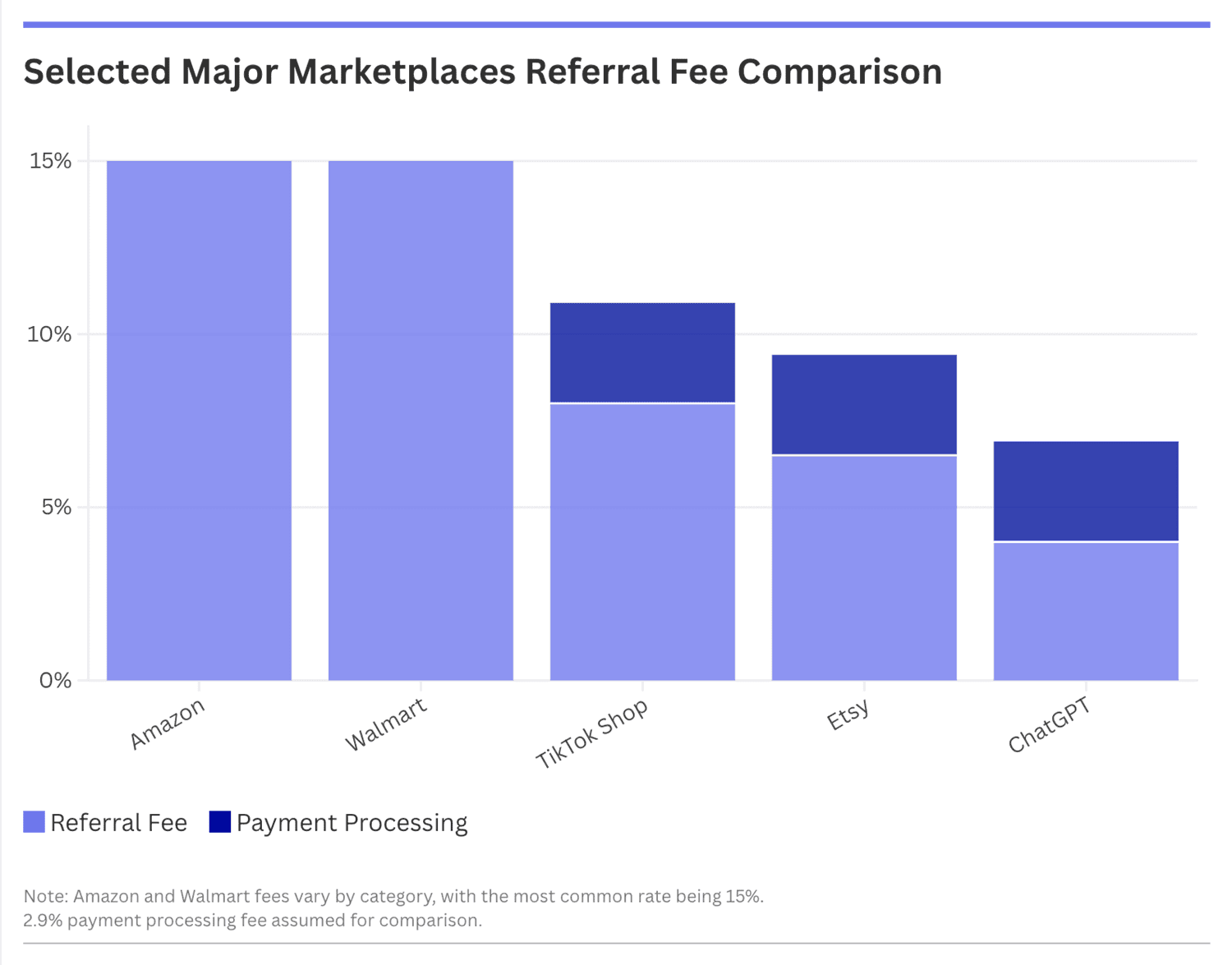

OpenAI has announced a new in-chat checkout feature inside ChatGPT, charging sellers a 4% commission on purchases made through the platform. The feature is currently available to sellers using Shopify — and the pricing is significantly lower than Amazon’s.

What happened

Starting January 26, Shopify merchants pay 4% to OpenAI on sales completed via ChatGPT. Combined with Shopify’s payment processing fee (around 2.9%), total costs come to roughly 7% per transaction.

For comparison, selling on Amazon typically involves a 15% referral fee, plus another 10–15% of revenue spent on advertising just to gain visibility in search results. In practice, Amazon often captures 25–30% of a sale before FBA fees are even factored in.

More than one million Shopify sellers now have potential access to ChatGPT’s audience, which generates an estimated 3.9 billion product-related queries per year. According to analytics platform Northbeam, AI-driven search traffic grew from 0.01% to 0.15% of total e-commerce traffic in 2025 — a 15× increase in a single year.

Why it matters

ChatGPT is offering something Amazon has largely eliminated: organic visibility without mandatory ad spend. OpenAI states that ads do not influence ChatGPT’s answers and are always clearly labeled. If this policy holds, sellers gain a channel where products surface through contextual questions, not keyword bidding.

This represents a fundamental shift: discovery based on intent and problem-solving, rather than who spends the most on ads.

What it means for Amazon sellers

For sellers, ChatGPT is a low-risk experiment. Integration doesn’t require inventory migration or operational changes, fees are fixed, and advertising is optional. For niche products that struggle in traditional keyword-driven search, this opens the door to true organic demand.

The real question is scale. Today, AI-driven commerce is still a small slice of the market — but it’s growing fast. If OpenAI maintains a clear separation between answers and ads, this could become the first genuinely organic sales channel in years.

Seller tipTo increase visibility in ChatGPT results, optimize listings for contextual queries rather than keywords alone. Strengthen product descriptions with clear problem statements, detailed specifications, and real-world use cases. ChatGPT ranks relevance by how well a product answers a buyer’s question — not by keyword density.

News #3. Amazon Cuts SAFE-T Claim Window in Half — Sellers Push Back

Amazon is reducing the time sellers have to file SAFE-T claims from 60 days to 30 days, effective February 16. Sellers say the change significantly weakens their ability to recover losses from buyer fraud and return abuse.

What happened

Amazon announced the policy update for FBM orders. Under the new rules, the 30-day window starts from the later of:

the date the return is scanned at the seller’s warehouse, or

the date the refund is issued.

For lost shipments, the countdown begins from the last carrier scan. Amazon says the change aligns SAFE-T with the standard U.S. return period and the A-to-Z appeal window. The company advises sellers to review all returns and refunds older than 30 days before February 16 to file any eligible claims.

Why it matters

SAFE-T claims are the only formal protection sellers have against buyer fraud, shipping damage, and issues outside their control. Reaction on the Seller Central forums has been overwhelmingly negative.

Sellers argue the system already rejects most claims, and that Amazon frequently allows buyers to select broad return reasons that qualify for free return shipping. The core frustration: buyers can initiate returns for up to 45 days, Amazon can take months to process FBA returns, yet sellers now have just 30 days to submit a claim once a return is received.

What Amazon sellers should do

Before February 16, sellers should audit all returns older than 30 days and submit SAFE-T claims where applicable. After that date, compensation opportunities may be permanently lost.

The change is especially painful for sellers who wait for final shipping cost data before filing. Going forward, sellers may need to automate return monitoring and submit claims immediately — even with partial data — rather than waiting for full reconciliation.

TakeawayBy halving the SAFE-T filing window, Amazon shifts more risk onto sellers. To protect margins, sellers will need tighter processes, faster audits, and automation — because delays now mean forfeited reimbursements.

News #4. Amazon Automatically Creates FBA Multipacks — A New Way to Increase Average Order Value

What happened

With Virtual Multipacks, Amazon bundles multiple units of the same FBA product into a separate listing — without any changes to physical packaging or inbound logistics. Sellers do not need to prep bundles themselves: Amazon assembles each order using existing single-unit inventory.

All virtual multipacks were created by January 23, 2026. Sellers can review or remove them until February 8 via Manage All Inventory (filter: VMP_). Starting February 9, any remaining multipacks will become visible to customers.

Each multipack receives a unique ASIN and SKU with the VMP_ prefix and appears as a variation on the single-pack product page. Pricing is set automatically by default — for example, a 2-pack is priced at 2× the single-unit price. Sellers can adjust pricing, apply coupons, and run ads, but cannot create new multipacks manually.

Why it matters

Amazon is testing multipacks as a lever to increase Average Order Value (AOV). For private-label brands, this is a low-friction way to offer bulk-style value without added packaging, prep costs, or operational complexity.

Each multipack can be advertised separately, collect its own variation-level reviews, and capture demand from shoppers actively searching for multi-unit or value packs.

What Amazon sellers should do

Review all auto-created multipacks before February 8 and adjust pricing. Leaving the default 2× price removes the incentive for buyers — a modest bundle discount can lift AOV without hurting per-unit margin. If you delete a multipack now, it cannot be restored later. There are no additional storage fees — Amazon charges the standard fulfillment fee per unit included in the order.

Virtual Multipacks give sellers a new, Amazon-managed way to boost AOV and capture multi-unit demand — but only if pricing is actively optimized. Ignoring default pricing risks missing the upside of the experiment.

Book a call now…

Book a call now…

Up to 45-min duration video-call

Topics we'll discuss:

| The next steps — there are two options

|